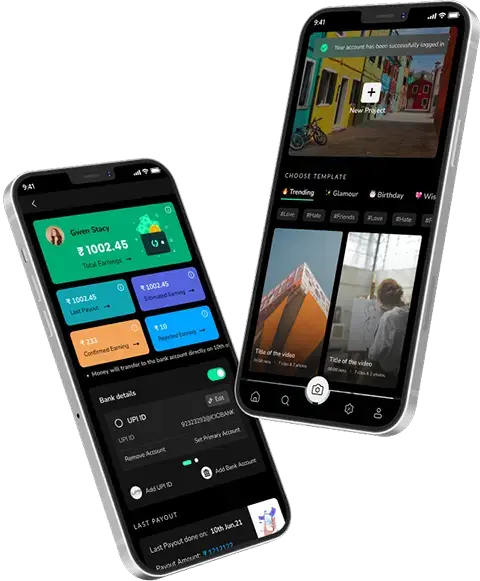

As mobile applications spread worldwide, they also affected the banking sector. That’s why the demand for FinTech app development is growing. Developing mobile banking apps with the expertise of a Banking App Development company In UK is a highly appreciated option to offer banking services with an entirely new level of convenience.

The banking industry has shifted towards mobile-based applications for commercial operations, wanting to offer a fantastic customer experience. Banking apps for mobile have streamlined offerings for both users and financial institutions. In the current competitive market, the increasing user demand has compelled banks to act and work with a dependable mobile banking app development business that can assist them in creating robust and highly scalable apps.

Banking apps for mobile devices are crucial due to the rapid change in lives. Banking institutions work with app developers to deliver resonant solutions. Mobile apps allow users to connect to banking services via their smartphones. They offer convenience and help banks increase their efficiency. The financial institutions that develop mobile banking apps stay in the game.

This blog is intended to provide complete information for mobile banking app development.

Understanding mobile banking app development

A mobile banking application allows customers of financial institutions to access financial services through the convenience of their mobile phones. In this way, customers use a mobile application that allows the bank to run online processes. It is generally true that an app for mobile devices comes with all of the services that users can use at brick-and-mortar banks and also a range of online-only, innovative advantages and benefits.

Banking app developers create apps with essential features designed specifically for the banking industry. These apps allow customers to perform banking and manage their accounts. They enable users to access banking services directly on their mobile phones. Banking institutions began offering essential mobile banking services in 1999.

Mobile banking software can improve customer experience. Banking applications should bring in revenue from the bank. Banks must create a banking application to serve their customers and their needs. They can make money through subscription-based services or advertisements. They must think about and develop a strategy to make money from apps. Many banks charge a charge for any transactions made through the app. Automate these fees to make your user experience easy. Maintain a certain balance throughout the process to prevent user irritation.

The creation of sophisticated apps that provide a single-stop bank solution began when the 4th industrial revolution was launched. They are now more secure and durable. They are user-friendly and are packed with useful functions and more laws and regulations regarding their use than when their creation began.

Benefits Of Mobile Banking Apps

Numerous benefits are associated with mobile banking applications. Learn how consumers can benefit and what advantages banks can reap using them.

1. Good ROI

A good investment can produce excellent yields. For business owners, this isn’t solely about profits directly; it’s also about cutting operating costs instead of using traditional banking methods. According to the study, through the widespread use of mobile apps, banks earn an average of 2 million dollars in additional annual revenues and as much as $38 million in additional yearly point of sale. The effort to develop an app is rewarded as increasing numbers of customers utilize the platform online.

Also Read : Successfully Developing A Mobile Banking App

2. Client Base Larger

Banks can use a mobile-based banking app to reach a larger population, reaching people away from the limitations of banks with physical branches and regular hours. This could be particularly advantageous when businesses are looking to increase their market reach.

3. The Value Of The Customer Is Boosted

In addition to banking transactions, Mobile applications can provide various features that make banking more enjoyable. The ease of use and variety of functions can encourage clients to use more of a service, thus increasing the value of their services for the company.

4. Improved Competitiveness

Today, the lack of a mobile-based banking application can disadvantage businesses. An app designed with user experience in mind could make a company stand out among competitors. While also drawing new customers in an industry where efficiency typically takes precedence over other aspects.

Also Read : Mobile Payment Solutions: Driving Cashless Transactions in Saudi Arabia

5. Branding Strengthened The Company

A branded mobile banking app conveys a strong message. The app positions the business as modern, creative, and able to meet contemporary consumer needs. It draws new clients and builds confidence and trust in those already there.

6. A Swell Of Channels For Communication

Mobile apps are not solely transactional platforms. They’re communications hubs that allow companies to send personalized messages and promotions, provide assistance, and collect feedback. Two-way communication improves the relationship between companies and their clients.

Why Are Customers Switching To a Mobile Banking App?

It is possible to answer this question using a simple question. Why would you go to banks when you can accomplish the same or more from home? Through banking software, banks have enabled clients to access their accounts with their phones. However, that’s not enough. Mobile banking applications can do more than that. We’ll review some convincing reasons that provide the solutions to create a banking application:

1. 24/7 Support And Accessibility

Using mobile banking software, clients can access banking services every day, every week. Traditional banking practices offered the hours of opening and lunch breaks, close times, holidays, national holidays, etc., which affected the availability of banks.

2. One App That Covers Everything

Banking applications are being developed, and numerous issues can be resolved. Apps offer functions for transferring funds, updating the customer’s financial information, making payments, settling bills, and shopping on the web.

Also Read : Unlocking Financial Prosperity: A Comprehensive Guide to Wealth Management Apps

3. It Is Time-Saving And Economical

The development of mobile banking apps helps to make banking transactions more cost-efficient. Banks don’t incur any fees to offer internet-based banking services. Utilizing the app can also be a time-saver because you do not have to stop by the branch constantly. The result of this benefit is that usage applications for banking on mobile devices has doubled within two years.

4. Quick Transactions

The public appreciates the development of banking apps for this reason. With just a couple of clicks, customers can transfer money anywhere in the world, and the process takes no less than one minute. This is among the best ways to succeed in deciding how to app launch for banking.

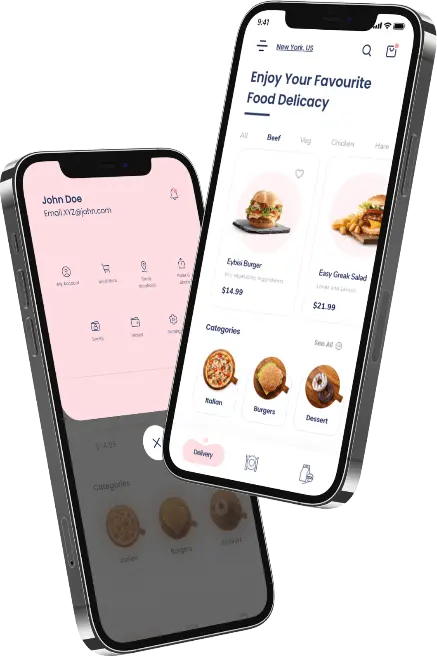

Types Of Mobile Banking Apps

A customized mobile banking platform can be designed to satisfy the particular needs of customers. We’ve covered this in detail and clarified it up to the present. What’s next to be understood is that types of apps exist to consider when thinking about the best way to create an app for banking. Below is a breakdown of the sub-categories of financial and banking app development will look like:

1. Retail Banking Apps

Mobile apps for retail banking are apps that banks and financial institutions can offer their retail customers to provide diverse financial services and functions. They are developed to allow users access to various banking options, including managing accounts, payments, and other services.

2. Investment Apps

Investment apps are applications for mobile devices that allow you to invest in many different products, including bonds, stocks, ETFs, mutual funds, and commodities, at any time and from wherever you are.

Also Read : Online Banking Management System – Its Scope and the Technology Used

3. Neobank Apps

Neobanks are entirely online, electronic banking services. They are not physically present. Transactions in traditional banks can require a considerable amount of client time and effort; however, with Neo-Banks, you only need a few clicks.

4. P2P Payment Apps

Payments via P2P Apps simplify money transfers by using only the name, email address, or telephone number to send or receive funds in minutes. With these applications, every account is linked to the account of the other user’s digital wallet. When a transaction occurs, the app’s balance is recorded, and it immediately removes funds from a user’s money account or the app wallet and then transfers it to the other account.

Also Read : Cryptocurrency Wallet Development – Does Your Crypto Grow In A Wallet?

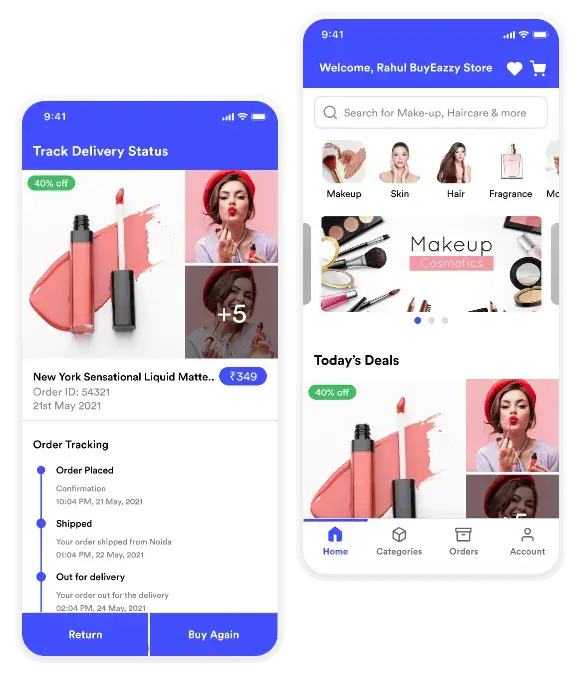

Must-Have Features Of a Banking App

An app for mobile phones is a lot more engaging and has new features. Certain features must be integrated if you plan to develop a mobile banking app. Below are the top features for mobile banking apps:

1. User Identity

Managing your user profile can allow you to add or update personal information. Set up secure authentication for users, including biometric authentication, an individual username, and an account password allowing login and transactions.

2. Account Overview, Setting, And Personalization

A complete dashboard is crucial for any bank app. It allows customers to quickly review their financial situation by adjusting settings. Users can also customize their dashboard to meet each individual’s preferences and needs.

3. Digital Wallet Integration

In the same way physical cash diminishes, digital wallets are integrated into banking applications on the Internet and have become more common. In conjunction with established apps like Apple Pay or Google Wallet, online banking apps can adapt to customers’ changing needs and offer various payment options. These seamless and secure transactions are the foundation of digital wallets that offer a fast and safe transaction experience.

4. Fund Transfer

Naturally, customers expect that any app for mobile banking will give them a wide range of transfer options, including peer-to-peer exchanges and international transfer options. Additionally, functions that permit the reprogramming of transfers that are either future-dated or recurrent are a huge improvement in user comfort and allow for more advanced financial scheduling.

Also Read : Build Money Transfer App: Everything You Need to Know!

5. Loan And Credit Features

Through the integration of credit and loan capabilities, consumers can apply for financial assistance through their mobile phones. This makes borrowing easier and ensures quick and easy access to cash when needed.

6. Currency Converter

A built-in currency converter allows banking applications to provide live conversion rates in real time, keeping users constantly updated. Additionally, it permits users to exchange currencies without hassle inside the app.

7. Round-Up Savings Tool

The basic idea behind round-up tools for saving is that they round all financial transactions up to the closest dollar. By converting the difference into savings, customers can accumulate savings slowly, making the process of growing their finances seem effortless.

8. 24/7 Support

Banking isn’t limited to the traditional hours of operation. Problems or queries can occur anytime prompt assistance is an absolute requirement. With support available 24/7 in banking applications, users can get answers to their questions immediately. This not only builds confidence but also improves the overall experience for users.

9. Transaction History

An extensive transaction history lets customers review their spending patterns and bank account activity. Additionally, transaction history is mandatory for any mobile banking app, card management, funds transfer, and other functions.

10. Investing

Provide a robust information base allowing users to study investments, monitor them, and establish high-level investment goals. Investors can track their investments by using their mobile banking application. You can purchase a new investment or trade in an existing one anytime through their mobile application.

Push Notifications And Account Usage Alerts

Utilization alerts and push notifications are not just a way to keep customers informed of their balances. They also alert them of suspicious activities. Real-time alerts offer additional protection that ensures users’ confidence.

1. Integration With Modern Technologies Like AI/ML

Thanks to AI, users will sometimes receive individual advice regarding finances and budgeting suggestions. AI algorithms improve security since they track each transaction’s pattern and transactions. Chatbots with AI capabilities can offer personal assistance at any point throughout the day. They can also analyze credit and offer users recommendations before the loan’s acceptance.

Also Read : Navigating The Impact of AI-Powered Apps on eCommerce Stores in UK

2. ATMs And Bank Branches Locator

A city’s location can make it difficult to get an ATM or even a bank branch. The application’s built-in locator will help users locate the closest ATM or branch easily. Utilizing geolocation ensures rapid access to bank services at any time.

3. Feedback And Reviews

By incorporating a feedback and review system into the application, banks can learn valuable data directly from their customers. The app allows banks to gain insight into users’ perspectives, needs, and points of disagreement.

Mobile Banking App Development Process

Applications for mobile banking are incredibly well-liked because they simplify users’ lives. This is the process to build the mobile banking app you want to use.

1. Research

It’s one of the crucial actions to be followed if you’re considering creating a mobile application. It’s vital to assess the market and the competition extensively. A thorough research will help you develop the best plan. The list should include all of the essential points, including who your customers are, their issues, and how you can address them. The final product should have a complete mobile banking app design plan that includes all estimations. An in-depth analysis provides everything from your profile to your value offer.

2. Build Prototype

Mobile banking applications are complicated, so it’s crucial to be aware of the specifications and develop prototypes. Following the approval of the prototype, additional actions may be taken. You must be mindful of your requirements and expectations. Making a prototype is an extensive process that allows you to determine the extent of any future projects and help design an item that meets customers’ requirements.

3. Setting Up a Robust Security Base

Data Security is the main element when designing a robust mobile banking application. Certain companies will hire Fintech app development company to develop applications with solid security. Security is not a matter of course within the banking industry. Two-factor authentication ensures security when creating mobile banking applications.

Also Read : Evade The Security Issues With Fintech Technology-Enabled Mobile App

4. Work On User Experience

The design team or designer must wear gloves and begin working at this step. If you’re building applications to help your clients’ needs, providing the best user experience is crucial. The navigation should be seamless, and the application is designed to be user-friendly. When you’re handling anything involving money, you must avoid any chance of mishaps that could trigger users. If users are anxious and dealing with vast amounts of money, they feel anxious. Creating an easy, simple, and friendly interface is crucial.

5. Final Development

Then comes the design phase. Research designs, development, prototypes, and tests are completed when the development process occurs. You know the precise requirements and have the best strategy for developing and marketing the mobile banking app.

6. Add Integrations

Integrations from third parties can enhance your application’s customer engagement and relevance. They provide a more user-friendly application and improve customer retention. Third-party integration solutions include payment aggregators, payment gateways, and more. Select them with care since they could help your app gain traction within the marketplace or ultimately sink.

7. Launch

This is the last step of the launch! Introduce it to your intended users after you’ve put in all the effort to create the app. It’s not over. When your software reaches your users, a brand new adventure starts. This means new demands and demands for the introduction of more features and more. It is essential to keep track of the performance of your application and strive to improve it each day.

Cost To Develop Mobile Banking App

The cost of developing mobile apps depends upon several variables, such as the technology you choose to use and the amount of time you put into it. It is, however, total development time x hourly rate for developers. Below is a graphic diagram of the price:

Various factors impact the overall price of mobile banking apps’ development. Take an analysis of every aspect:

1. Wireframe

Wireframes are created using software like Figma or PhotoShop. They are the overall architecture or blueprint for the banking application’s design. The final wireframing, which gives a clear vision of the product, will be created following multiple testing methods.

2. UI/UX Design

Develop a simple design that can add all the information in one location. A simple layout is the most effective approach. It facilitates navigation, improves app retention, and keeps them on the move.

3. App Platform

The base platform determines the price. While choosing the iOS or Android platform will typically have little influence on the budget for the app, it’s generally recommended initially to go with the former because of its huge customer base. It’s easy to have your banking application initially developed for one platform before moving on to cross-platform development when the app gains some recognition in the marketplace.

4. Team Size

Cost estimation heavily depends on the team size. The goals you’re trying to reach will depend on your budget. Funding is within your financial capability if you have an internal development team. If not, you’ll need to outsource your mobile banking app’s design team or an individual. While they might start charging extra, a reputable bank mobile app development company is likely to provide a more significant ROI due to their superior quality of service.

5. Technology Integration

Technology integration is yet another crucial element directly related to the price of building a banking application. Integrating advanced technology like blockchain or AI/ML is advisable because it will help you in the future. The incorporation of these technologies can increase the value of your application but also increase costs.

6. Features

The more options it contains, the more are likely to pay. The right combination of functions is among the critical elements of developing banking mobile apps. The development cost will dramatically grow as you get greater complexity or more advanced options.

7. Maintenance

It is essential, however, and it will be ongoing following the release of the application. It is the primary factor which determines the overall costs for development. Keeping your mobile banking application high-quality is crucial to providing a fantastic user experience. It’s important to realize that once the app is launched, it will store users’ data and actions, so app maintenance is crucial. Apps will need regular cleaning, regular search and removal of bugs, and regular updating.

Tips To Build a Successful Mobile Banking Application

You may be wondering how to begin creating a banking app. But before doing so, there are a few other aspects to be aware of. There’s no straightforward method to create a profitable mobile application, and developing mobile banking applications gets more complicated. If you are developing an app for banking, make sure that it is an application that customers can rely on to execute transactions efficiently.

In developing a mobile bank app, creators and owners should know these essential aspects.

1. Security Is An Important Aspect

Mobile banking apps are available for Android or iOS. Securing the app is essential. In the above data collection, it’s clear that security and trust are the most important reasons a client will not choose mobile banking. Mobile banking technologies must be secure enough to ensure that customer’s details are secure. The technology should also be secure against hacking and protected from cyber-attacks.

2. Know Your Target Audience

The assumption is that banking apps on mobile devices are only for the millennials and not for any other group of people. This is not the case. Many baby boomers and senior users still use applications for mobile banking. Many millennials are not satisfied with the current banking apps, which proves that the presumed target audience for the app is not valid.

3. A Minimalist And Elegant Banking Application UX

The user experience of an app will be, without a doubt, an essential element. Future mobile banking relies heavily on the user experience of the banking app. The significance of UX design and layout of apps can be evident when the user is confronted with constant crashing, faulty functionality, and unresponsive applications.

The UX must be user-friendly and designed to provide the most user-friendly experience. An excellent UX will result in new customers and improve the results of the mobile banking application design process.

Also Read : Don’t Fall For These Threatening UX Design Faux Pas!

4. Check Out The Banking Mobile App Style And Functions

If you’re working with companies that develop apps, you’ll have a lower chance of making mistakes. They have skilled developers and innovative creators. They also tested the mobile application to ensure the best result. However, suppose you’re creating this app independently or hiring a Trading App Development Company; in that case, you should ensure the tests pass when making a bank application.

5. Whom Are You Building To Cater To?

Android fans and iOS users are concerned about which mobile app development platform is best for developing apps. Although Android has more mobile users, iOS has a higher conversion rate. Be aware of your goals for where you’d like to travel.

Additionally, the device that will be used to develop the banking software must be considered. Users can switch from smartphones to tablets and back, so the app must be designed to run across different gadgets.

Also Read : India – A Gifted Platform For Mobile App Development Services

6. It’s Should Be Simple And Fast

The top mobile banking functions are easy to use, stylish, and don’t hinder the speed of your app. In addition to the security risk, what makes people abandon apps for mobile is the speed of the application. You should avoid these things in your development experience: insecure logins, excessive feature complexity, bad user interface and banking app and design, and lack of quality in the application.

Conclusion

Developing a mobile banking application can be a chance for young companies to get their feet on the ground using a customized or all-in-one Fintech solution. In the same way, established companies could significantly improve their standing in the market by using this type of intervention. The issues of selecting the right features, quality development, the highest quality of work, and picking a trusted supplier to care for all technicalities are crucial.

The rise of digital options has completely changed the conventional banking system. This article will assist you in implementing your mobile banking application idea into a reality. Suppose you’re planning to create an app for mobile banking. In that case, this is the best time to use the latest technology and trends to develop an innovative solution for your clients. Regarding financial operations, your primary concern will be data security. This is why selecting a reliable and reputable app development firm with a history of developing robust apps and assisting businesses in creating them is vital.

Get in touch with techugo to start your development process!

Post Views: 1,528

SA

SA

KW

KW

IE

IE AU

AU UAE

UAE UK

UK USA

USA

CA

CA DE

DE

QA

QA ZA

ZA

BH

BH NL

NL

MU

MU FR

FR