Ever wonder how banks manage to manage countless transactions, international currency values, and customer records while ensuring smooth and secure services? The secret lies in an online banking management system!

This powerful solution streamlines everything, from automating tedious record-keeping to maintaining a stable financial structure. An online banking management system benefits both banks and customers. Banks gain efficiency and accuracy, while customers enjoy transparency and quick access to services.

Imagine having the ability to review your past transactions or update critical data effortlessly, all with just a few clicks. That’s the magic of this technology—it empowers banks to serve better while making the entire process seamless for users like you.

Curious about how this system is revolutionizing the world of banking? Let’s dive in and explore!

SCOPE:

- The application allows customers to create new accounts and choose between savings and current accounts. This application saves customers the hassle of visiting the bank to create or use these accounts.

- Depositing Money—With the global shift towards less common paper currency, depositing or transferring money between banks will be as simple as clicking a few buttons on the mobile app.

- Withdrawing Money – You can also send requests through the application for money transfers.

- Administrators can view the Account Holder List. Administrators can see the complete list of account holders.

- Balance Enquiry – This application allows customers to check their balance.

- Change Passwords/PIN – Customers can easily change their passwords and PINs using the application.

- Closing– Customers can also close their accounts using this application.

Now, let’s dive into the technologies that ensure a smooth, secure user experience.

TECHNOLOGY USED:

- JAVA: The Java programming language is straightforward to use but extremely powerful. It was created by Sun Microsystems in 1991 and can be used on any platform. Renowned for its “write once, run anywhere” capability, Java is the backbone of countless enterprise applications, mobile apps, and web app solutions. Its robust ecosystem and extensive libraries make it a favorite among mobile app developers worldwide.

- SWING: Swing can be described as a widget GUI toolkit used for Java. Swing was designed to offer a more advanced and sophisticated approach to a limited set of GUI components than the earlier AWT (earlier abstract Windows toolkit). Swing provides users with more advanced features like tabbed panels, scroll panes, and trees.

- MY SQL: MySQL, a well-known open-source relational SQL system, is a database management software. It’s a relational online bank account management system that can be used to develop various web projects. Known for its speed and reliability, MySQL handles large datasets efficiently, making it a popular choice for dynamic websites and applications. Its compatibility with multiple programming languages further enhances its versatility in app development.

- MULTI-THREADING: This allows us to break down a program into smaller parts, each of which can be classified as a thread. If a lightweight process acts as a virtual CPU, it will execute your code and other system calls. These lightweight processes are not necessary to run programs with a few threads. Each thread can perform independently, and multiple lines can be run simultaneously.

Also Read : Reinventing the Financial Landscape Via AI in Banking

Online Banking Statistics

- Average Number of Bank Accounts: Because of the many benefits, people tend to have more than one bank account. According to statistics from 2019, the average client has more than five accounts in all types of financial institutions. 49% of people open an account at a bank because they feel comfortable there. In addition, 26% have an existing card from the institution, and 14% keep their investment.

- Online Banking Usage: According to a survey conducted in 2023, 66% of the United States population used online banking, and this percentage has only increased in the past years.

- Mobile Banking Adoption: A survey conducted in 2023 found that more than two-thirds of the members used a linked mobile application on their phone or other devices to operate, which shows an uptrend in the use of digital media and banking channels.

- Digital Banking Trends by Age: The same survey found that 90% of adults aged 18-44 managed their bank accounts using a mobile device, compared to 62% of those aged 65 and older.

- Digital Payment Growth: While specific growth percentages for digital wallets in 2020 are not provided, the increasing adoption of digital and mobile banking platforms suggests a significant rise in digital payment volumes during that period.

- Wearable Payment Devices Market: In 2020, the global market for wearable payment devices was valued at approximately $10.35 billion. Experts forecast a compound annual growth rate of 29.8% between 2021 and 2028, indicating a robust expansion in this sector.

Also Read : 15 Game-Changing FinTech Trends Set to Revolutionize 2025!

Bank Industry Trends to Watch in 2025

2025 will also experience increased dynamism in the banking industry because of changes in technological features and client expectations. The digital shift is the most prominent and refers to changes in the banking industry and customer relations.

1. White Label eWallet

The pandemic has inspired users to explore digital wallets, a contactless mobile banking option that allows users to make payments from almost any iOS or Android device.

It also offers businesses a customized customer experience without costly and time-consuming development.

2. Self-Service Applications

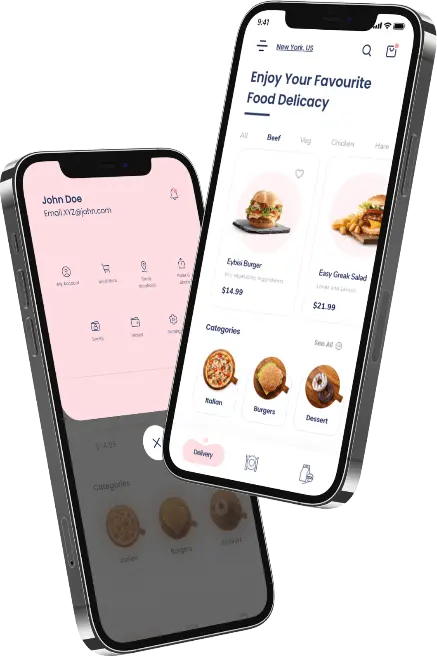

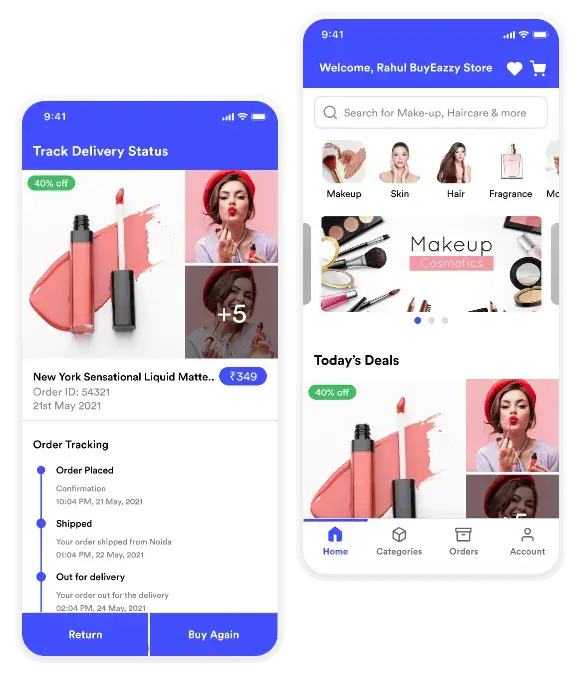

Self-service apps are among the most crucial online banking technology trends, especially in millennial banking. They allow customers to manage their wealth and make financial transactions, such as withdrawals or deposits, inquiries, transfer payments, bill payments, loans, currency change, and other matters, directly from their app profile.

Various businesses in the banking sector can optimize, automate, and improve client engagement.

Clients no longer need to be present in person to make any bank transaction. Instead, all these transactions are included in the client’s banking app.

Also Read : Creating a Successful P2P Lending App in 2025: A Complete Guide

3. Cross-Platform Services

Transactions are also involved in healthcare, retail banking, insurance, hospitality, and other industries. This is why integrating cross-platform payment options, such as mobile payments and hybrid wallets, can dramatically increase the income of businesses and financial institutions they work with.

Businesses and entrepreneurs can quickly complete transactions using embedded payment services within the app without compromising application security.

This digital banking trend is also much simpler and quicker to launch and maintain than native apps and between 15% and 50% cheaper!

4. Implementation of API

API, or Application Programming Interface, is used in banking to synchronize, link, and connect any service database with any other application. It acts as a bridge to ensure the safe transmission of personal data without involving any third parties.

The API trend in private and commercial banking also makes these financial institutions more transparent, secure, and accessible to their clients. This is undoubtedly a huge benefit for both businesses and financial institutions.

5. Video Banking

Video banking technology is another emerging trend in banking. This technology allows clients to optimize their remote services and improve their workflow. In addition, this approach will enable customers to be more engaged with their financial institutions and provide for online processing of various in-person procedures.

This banking trend has particular benefits for consumer and investment banking.

Video banking optimizes various banking processes to provide smooth and efficient client service. Automating and optimizing workflows can help financial institutions reduce the time and cost of processing client requests.

6. Open Banking is a great way to increase your business

This increased interest in online and mobile banking has led to Open Banking, a new type of financial innovation.

This technology allows clients to consolidate and access financial data from multiple organizations and institutions through an open API. It will provide a seamless and flawless experience.

This technology will enable Open Finance, which allows third-party providers to access clients’ financial information after consent.

7. Contactless Payment Methods – Cash or Other than Cash

The latest crisis has drastically changed people’s lives. People increasingly turn to online transactions and digital payments because they feel less connected.

Many countries are planning to eliminate cash and completely switch to digital transactions. Transforming banks into a cashless society will reduce the costs associated with handling hard money.

Banks will find it easier to analyze digital transactions and understand client spending patterns.

Also Read : The Ultimate Guide to BNPL App Development in the Evolving FinTech Sector

8. Shift to Composable Architecture

Many banks will likely switch to composable architecture to better respond to future crises and challenges.

It is possible to transition step-by-step. This flexible and scalable solution will allow financial institutions to optimize their internal processes.

A broad investment in the transition towards composable architecture will be a bank trend for the following year.

9. Robotic Process Automation for Greater Efficiency

Robotic Process Automation, or simply RPA, is another trend in banking that institutions are keen to embrace for greater productivity and efficiency.

This can help save money and replace or assist employees with tasks that minimize errors, maximize accuracy, and improve the client experience.

This fantastic solution will soon revolutionize the online bank management system and be available to all mobile app development companies of any size.

10. Cybersecurity is the focus

A FinTech app development company will pay more attention to cybersecurity because most financial transactions are online. This will ensure that the client’s financial information is protected and secure.

These data are easy targets for hackers. Therefore, cybersecurity must be a top industry priority to avoid reputation damage and financial loss.

Now, let’s explore the features you must have in your online banking management system.

Also Read : How much does it Cost to Develop an App like DIB (Dubai Islamic Banking)?

Digital Banking Features

These are the best features of digital banking, which have made it more popular than traditional banking.

- Online banking: An online bank management system allows customers to access all banking services anytime and anywhere. Many banks also offer a variety of technological solutions that make banking easy. These banking features can be accessed online.

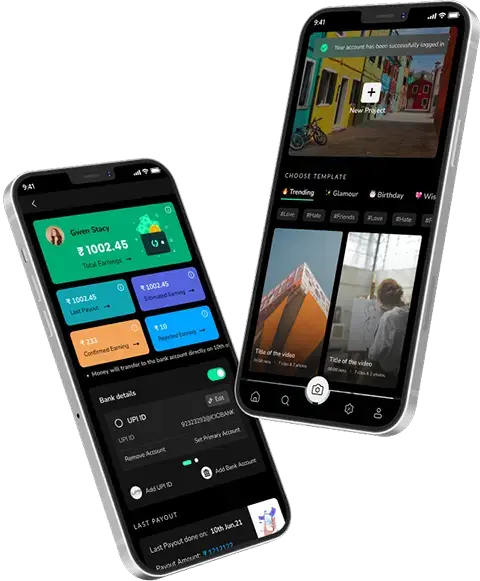

- UPI: The National Payments Corporation of India has developed the Unified Payments Interface for real-time inter-banking transactions. With just a few clicks, you can perform fund transfers quickly by integrating UPI and digital bank services.

- Personal financing options: Many Indian banks offer next-generation banking services that allow customers to access many online tools. For example, you can manage your investments, credit, savings, and other financial matters with the eligibility calculator, EMI calculator, and FD calculator.

- Loyalty programs: Today, individuals can participate in many banks’ loyalty and rewards programs. For example, reward points can be earned based on bank or partner transactions. These points can be redeemed later and receive attractive rewards like cash back or discounts.

- Digital wallet: In the last few years, digital wallets have been trendy. People don’t have to keep cash around as they can make necessary transactions on their smartphones.

- Mobile banking: Most financial institutions now offer mobile banking services, so consumers can do all their banking through the mobile terminal. Users must install a necessary application and enter the login details to log in.

- Phone banking without the Internet: Banking facilities are available for those who do not have an Internet connection. This allows you to access banking services via SMS, phone calls, or USSD. This feature will enable individuals to access banking services without fees, even in remote areas.

- Message alerts: Secure message alerts are one of the most critical aspects of digital banking. Instant alerts via SMS can be sent to individuals whenever there is any activity in their bank account. In addition, these alerts can be used to prevent fraudulent transactions.

- Remote advisor: With remote banking, customers can now have a seamless user experience. Thanks to the services of dedicated digital relationship managers. These executives can take care of your banking needs beyond regular banking hours.

- Automated payment of bills: Automatic bill payment facilities make it easy to pay your bills. Customers can now link their monthly bills to their bank accounts through banks. In addition, one can receive timely reminders from banks about bill payments.

Also Read : The Ultimate Guide to BNPL App Development in the Evolving FinTech Sector

How to choose the right tech stack for your bank app?

There is no one-size-fits-all solution. A tech stack is a collection of tools (programming languages and frameworks, libraries, etc.). A tech stack is a set of tools to create a software product.

Different projects will require different tech stacks based on industry requirements. So, let’s look at some of the critical factors that influence the choice of the technology stack for a bank app.

- The complexity of the project: No one is surprised that more features in your banking app will require more technology. Integrations with other platforms can complicate the project. You must do it with more than just a few technologies. App developers need to determine the scope of work and a list of product features required to do it right. A well-chosen tech stack will only be possible if you have clearly defined project requirements.

- Rapid development: A fintech app’s development speed will impact not only the time it takes to get your product to market but also its cost. The process will take longer, which is obvious. Consider technologies that offer ready-made solutions to speed up the development process if you are working under tight deadlines. For example, your development team may use Kotlin instead of Java to build an Android app. You can also create an MVP version of your product that includes core functionality and add additional features later. You can do what you want. Your business goals will influence your choice of the cost to build a mobile app.

- Budget: When choosing technology, it is essential to consider the budget required for product development. This could be a mobile banking app, web-based NeoBank, or full-fledged NeoBank. Many libraries and frameworks can be used to implement the desired functionality. You only need to decide whether you can spend money on paid tools that offer greater flexibility or security. An experienced development team will work with you to determine the right mix of open-source and commercial technologies to meet your needs.

- Security: Security is a crucial consideration when developing fintech apps. Mobile apps have many security options, but choosing the one that best suits your product is essential. Secure frameworks and libraries are among the best ways to protect the system. In addition, you should select a technology stack that improves the product’s reliability. Finally, avoid technologies that are susceptible to fraud or other threats. Advanced technologies like AI or Blockchain can provide a significant advantage by providing high levels of security for data storage and execution.

- Integration: Integrations are critical in choosing the cost to build a FinTech app. Developers must make sure that all platforms can be integrated with third-party APIs. A tech stack audit is performed to identify all possible platform connectivity options. Make sure you tell your developers what integrations are required for your app so technical specialists can consider this when creating product architectures and choosing technologies.

- Product architecture: Software products are made up of many components. The development team determines how these components interact while building an app architecture. An example of a microservice architecture is an application with several related services. Each service can be created using the best technologies. You may, however, find a different architecture that suits your needs. It all depends on your project’s requirements and the required functions. Your project’s architecture will determine the technology pool available to you. You can make your app more reliable and secure and perform better.

Also Read : Driving Progress: The Rise of Software Development in the Middle East

Benefits of Online Banking Management Software

Online banking management software is revolutionizing the way financial institutions operate, bringing efficiency and convenience to both customers and administrators. Here are some key benefits of implementing such systems, especially when it comes to banking app development:

1. Enhanced Accessibility: Online banking management software allows customers to manage their accounts online. Users can check balances, transfer money, and view past activities on an account at home, work, or on the move. The accessibility of these banking services helps customers find solutions without much effort and time.

2. Streamlined Transactions: Banking management software makes performing basic operations such as shifting funds, bill payments, and account handling easy. It also means these tasks can be processed automatically and more efficiently with minimum operator interference. This efficiency benefits customers, relieves the burden on the bank’s employees, and enhances secure transactions.

3. Improved Security: Under online banking management software, the customer’s information is protected using data encryptions and other forms of authentication. Regular security updates ensure protection against evolving threats, giving customers peace of mind. These security measures are vital to maintaining trust in digital banking services.

4. Efficient Data Management: Online banking software helps banks store large amounts of data and access it as and when needed. This integrated data processing structure allows customers and bank employees to easily find important data and information. Real-time updates improve the systems’ operational effectiveness through easy transaction completion and account management.

5. Personalized Customer Experience: Leveraging customer data, online banking management software can offer personalized financial advice, product recommendations, and promotions. The software will track users’ behavior, enhancing client satisfaction. Personalization can also increase the link between banks and clients, increasing customer loyalty.

6. Real-Time Monitoring: Customers with online banking software can view account activity, transactions, and balances at a glance in real time. This means that users can always know their financial position without necessarily having to seek the services of a professional. In general, such practice allows banks to recognize fraudulent actions and respond accordingly within the shortest period.

7. Seamless Integration: A top banking software that easily integrates with other financial tools like budgeting apps, investment platforms, and payment gateways. This seamless integration enhances the overall banking experience for customers, making it more efficient. It also enables banks to expand their service offerings without disrupting their operations.

8. Enhanced Scalability: As customer demands grow, online banking software allows banks to scale up their operations effortlessly. The system can handle increased workloads by adding new features, expanding customer bases, or processing more transactions. This scalability ensures that banks meet future demands while maintaining high service levels.

The best banking software empowers customers and financial institutions, creating a more efficient, secure, and sustainable banking environment.

With these benefits, an online banking management system ensures efficient bank operations while delivering an unparalleled customer experience.

In A Nutshell!

As the world shifts towards digitalization, online banking management systems are poised to become a central pillar of modern financial services. Whether you’re a bank aiming to streamline operations or a customer seeking greater convenience, embracing these technologies ensures a secure, efficient, and personalized banking experience. Partnering with a mobile app development company can further enhance the functionality and user experience of your banking platform, ensuring it stays ahead in today’s competitive landscape.

Get in touch with Techugo, an on-demand app development company, to discuss possible opportunities that can help you implement innovations to take your operations to the next level and keep up to date with the banking tech trends.

Post Views: 7,425

SA

SA

KW

KW

IE

IE AU

AU UAE

UAE UK

UK USA

USA

CA

CA DE

DE

QA

QA ZA

ZA

BH

BH NL

NL

MU

MU FR

FR