The financial technology industry, known as fintech in the United Kingdom, has experienced transitional growth within the last two decades.

Initially, what was just a tiny channel has evolved to become a global market that changed the way of interacting with financial services for companies and clients. Based on the identified objectives, this insight discusses the UK fintech market development’s significant milestones, current trends, and prospects. While watching the show, both UK-based businessmen who are potential buyers of fintech services and ordinary viewers need to get acquainted with this market.

Join me as we dive into the new boom in the fintech industry!

Read more – Unpacking the Latest AI Trends in FinTech Market Shaping The Digital Economy!

The Emergence of the Business

The fintech revolution in the United Kingdom started in the early 2000s due to the development of technology and the use of the internet. At the same time, online banking as a segment contributed to the development and the first wave of financial technology (fintech) startups was initiated to cover payment solutions and the online lending segment.

The market was soon introduced to mobile payment and tech companies, now known as Wise. The UK fintech market had arrived by 2010. However, Innovate Finance reveals that the UK fintech sector only received £100 million in 2010.

An important factor has been the supportive regulatory environment provided by the government, especially when it established the FCA in 2013. The FCA’s attitude towards regulating fintech activity created quite a favourable and relatively stable environment that allowed the app development company in UK to develop and grow.

Read more – Unpacking the Latest AI Trends in FinTech Market Shaping The Digital Economy!

Mobile banking and payments

It has become a general trend that has been encouraged by technological advances and techniques.

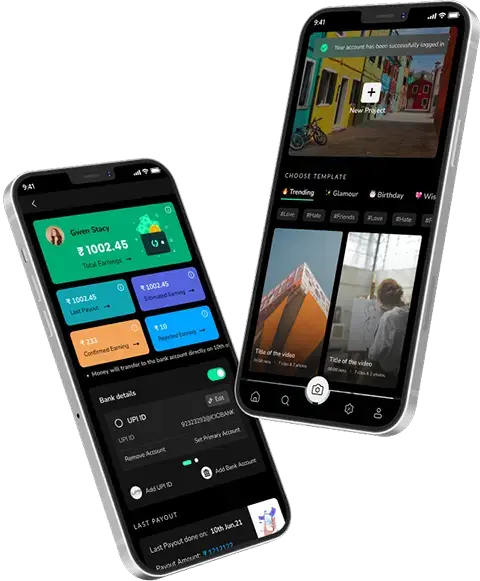

The immediate past five years, starting from 2010 up to 2015, have been noted for very high publicity of smart mobile phones, which acted as an impetus to mobile money and banking. More firms like Monzo and Revolut, which are fintech firms, have appeared, catering to the generation that is always on their screens, mostly for mobile banking.

Mobile payments to retail stood at £ 25 billion, up from £ 3 billion in 2012, thus representing 20 percent of the overall payment transaction in the same year, following statistics from UK Finance.

This was accompanied by the growth and development of conventional mobile payment methods, which were rapidly adopted by the consumer and business communities.

The government continued enhancing the sector’s innovation after launching the Open Banking project in 2016. Implementing open banking forced banks to share customers’ data with third parties, opening new prospects for fintechs to create advanced products and various services.

Next, we’ll explore finance industry growth and expansion.

Fintech Diversification and Expansion

The change in the structure of fintech with a mobile app development company in UK between 2015 and 2020 was characterized by the diversification of offerings. New sub-sectors that branched out and were used in financial services include insurtech, regtech, and wealthtech. Thus, the diversification enticed a lot of interest. UK fintech companies raised £4.

At this time, the United Kingdom moved to the position of the leading European country in terms of fintech, and London played the leading role in that process. It had an environment that was friendly to startups, accelerators, and incubators, which the city managed to attract globally. According to a report it is revealed that London alone had about over 50% of all European fintech investment in 2019.

As such, new measures, such as the bank and Fintech industry Strategy, unveiled in 2018, continued to support the industry’s development by fostering cooperation between new players, such as fintech firms and conventional financial institutions.

The Impact of COVID-19

COVID has boosted some new trends like online work and payment!

Therefore, the COVID-19 pandemic influenced the fintech sector significantly by intensifying the implementation of the digital transformation process and raising awareness of the necessity of digital financial services. Due to factors such as the lockdown and social distancing, demands for online banking, contactless payments, and other services for remote financial transactions increased.

A report shows that digital banking usage in the UK grew by 20% in 2020.

New players in the financial technology markets proved flexible, introducing new products and services as they responded to the changes.

However, due to the pandemic, the economy slowed, but investment in UK fintech continued growing, reaching £3.8 billion in 2020, Innovate Finance. This resilience proved the strength and flexibility of the non-linear business model of the UK’s fintech sector.

Modern Developments and Initiatives (2021-Present)

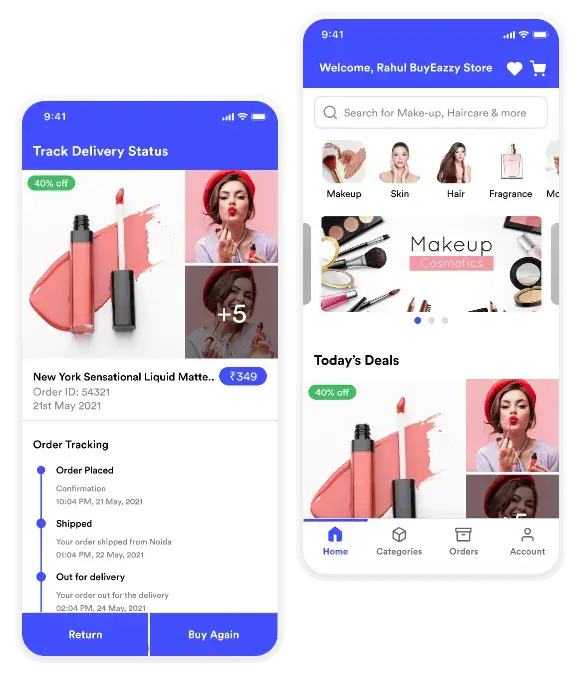

This paper seeks to examine how the UK fintech industry is shifting as the 2020s progress due to the development in technology and consumers. The trends include DeFi, the incorporation of Artificial intelligence (AI) in financial sectors, sustainability, and ethical financial systems.

As highlighted in the Fintech report, fintech funding in the UK in 2022 rose to £11.6 billion in the first quarter of 2018 by deal count. Major transactions in fields such as blockchain, cybersecurity, and digital identity services supported the massive growth.

Also note that fintech firms are specifically investing in the drive to foment financial inclusion, given that they have started designing products for mass markets and increasing the availability of financial services. The Financial Inclusion Commission estimates that 1.3 million UK adults will be newly engaged with financial services through fintech solutions in 2022.

Also, it has been identified that the utilization of fintech services among Small and Medium-sized Enterprises (SMEs) has increased significantly. According to a British Business Bank report published in 2023, the usage rate of UK SMEs with at least one fintech service reached 67% in 2023, compared to only 45% in 2018. This demonstrates the growing reliance of businesses on fintech for operational efficiency and growth.

Why do Businesses choose Fintech Business Accounts?

Tying in with the above reasons why consumers go for Fintech Business Accounts can be the following;

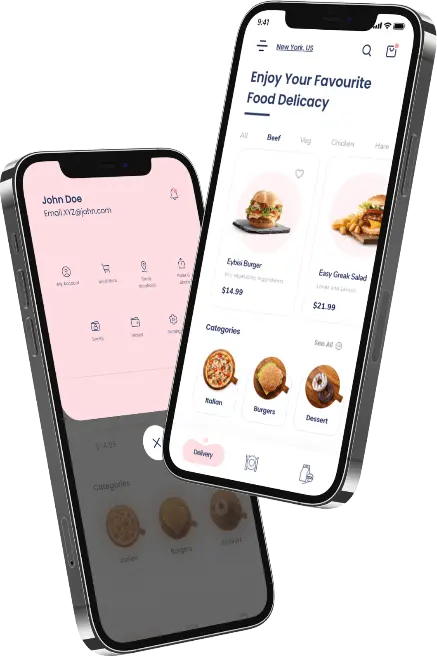

This has been regarded as one of the most dramatic changes that has happened in the financial segment: business banking has been replaced by fintech business accounts. Fintech solutions have higher benefits aligned with modern business online needs, which makes the operation of such solutions suitable for UK business owners.

Fintech business accounts offer greater freedom and convenience. They can be set up with several clicks, visualize the process of transactions, and interact with other business tools. In 2023 there was a survey conducted in the United Kingdom, most firms claimed that the use of fintech business accounts enhanced operational efficiency by 75%.

Other significant benefit includes cost saving:

There is also widespread agreement that research needs to pay more attention to the role of implementing technological tools in the environment despite its importance in achieving the goal of this process. The benefits that can be mentioned include cost savings. Conventional financial services the online banking management system provides are pricey and accompanied by various obscure fees, while Fintech services are comparatively cheaper. FSB commissioned a study revealing that some businesses in the UK that apply fintech solutions get a £1,500 annual cut on their banking charges.

Moreover, as mentioned before, most business accounts that operate in fintech include enhanced security measures to counteract fraud and cyber risks. According to Cybersecurity Ventures, in a report dated 2022, fintech platforms have lowered fraud incidences by 25 % compared to traditional banks, giving businesses assurance in their financial operations.

2024 List of Most Used Backend Technological Tools

One may choose many backend web development trending technologies from the vast array of options. Here are some of the most widespread technologies in the current market:

1. Django

Django is a Python web framework that offers a robust set of tools focusing on speed of development and highly readable code. This is why it is widely used to create secure web applications.

Advantages of Django include:

- Combining this with a ‘batteries-included’ approach with many features built-in on the device.

- Considerable interest in security is significant for organizations that process data with high sensitivity.

- Architecture that can conveniently meet the needs of large-scale application

- Increased amount of ecosystem and community support

- ORM for easier handling of databases.

2. Express.js

Express. Js is entirely usable, with its simplicity and adaptability to being a Node: js and a well-known lightweight framework for high-performance APIs and web application development.

Advantages of Express. Js include:

- Relatively fast and lightweight, it is best used for constructing high-performance applications.

- Another model is the non-blocking I/O, which allows the processing of many connections at once.

- Extensive ecosystem of middleware and Node. js packages for such additional functionalities

- It is easy to learn and use; its routing and middleware is a minimalist approach.

3. Ruby on Rails

Ruby is a relatively young latest technology commonly used for fintech software development projects. Ruby on Rails is characterized by features such as the convention over configuration principle and the ability to work quickly.

Advantages of Ruby on Rails: Advantages of Ruby on Rails:

- Convention-based development with rapid application development is prominent.

- High % of supply compared to the demand for Turbo Pascal and standard library included in Pascal and many operational built-in functions

- Rich use of tests and insistence on code quality.

- They both have vast and active members and consist of numerous plugins and gems.

- Stress on employing REST for application development.

4. Kotlin

Kotlin is a modern, statically typed programming language that is fully interoperable with Java code and widely used in Android and iOS applications development and server-side applications. It is often DashDevs’ go-to programming language for many of the fintech initiatives that they undertake.

Advantages of Kotlin:

- It’s organizing the language for expressing ideas tidily and efficiently, minimizing unnecessary code.

- Total compatibility with Java will enable the integration of Pleasant’s tools with the current Java projects.

- Type inference which is more concrete compared to non-type inferred, thus more safe and readable code

- The implementation of coroutines for better use of asynchronous code.

- Having a large community and expanding usage within the field.

5. Python

Python is an imperative and highly efficacious language owing to its accessible writing style, strong interpretation, and availability of extensive libraries, and libraries thus used in numerous applications like web development software, data analysis, and machine learning.

Advantages of Python:

- Gentle to the learners, especially those who approach or actively practice the foreign language, are easy to read and have simple syntax and grammar.

- Extensive standard library and third-party modules for almost any kind of task

- There is also high support for scientific cloud computing and data analysis, which are necessary for efficient data processing.

- A lively and populous community full of information, products, and people who are always willing to help

- Integration with other backend languages and platforms.

Backend Technology Selection in a Project’s Fintech Stack: How To Do It

The choice of backend technology like Blockchain which provides extra security, plays a very important role in the efficiency of any project in fintech, firstly because this field is quite specific and secondly because it is constantly undergoing active development.

Factors to consider in this regard:

- Language popularity and ecosystem: Perhaps it is better to use languages like Java and Python, with all their incredible collections and tested financial solutions, or C# if you are not an extraordinary backend programmer yourself.

- Performance and scalability: Ensure that the finance technology can work at a large capacity and process large numbers of transactions.

- Security: Focus on methods that ensure high security and protection for the monetary information.

- Regulatory compliance: The last aspect is to select a stack that complies with the applicable financial laws.

- Community and support: Focus on the developer ecosystem of the products in question and their documentation.

- Integration capabilities: Choose technologies for which integration with other systems and web services is not a problem.

- Testing and quality assurance: Stress on the testing and QA to keep the application up to date and efficient.

In general, the proper choice of backend technology and the priorities of performance, security, and scalability are essential to creating a successful fintech in investment banking applications. But a lot depends on a business’s development capabilities and specific goals and requirements. If you have limited choices, it’s better to select the technology that corresponds to the above criteria.

The Potential of Financial Technology in the UK

In the subsequent years, developments in UK fintech are anticipated to persist and even thrive at the ensuing rate. The government’s support towards the sector, along with a rich talent pool of new-generation and a complete guide for entrepreneurs and increasingly prominent large firms, places the UK in a league of its own regarding fintech.

Quantum computing, big data, and artificial intelligence are the emerging technologies that will make it possible for fintech to progress, become more intricate, and individualize their channels and forms of monetary administration. Various companies forecast that the UK fintech sector will have a CAGR of 22% from 2023 to 2030.

Thus, the cooperation of finance app development company in UK with traditional fintech organizations will continuously gain relevance as the industry develops. The cooperative can use each organization’s unique characteristics to foster inclusion, integration, and the economic system’s ability to cope with adversities.

Conclusion

The fintech industry in the UK has experienced extraordinary growth with banking app development company over the past two decades, evolving from a small niche into a global leader in financial technology. Starting with online banking in the early 2000s and supported by a favorable regulatory environment, the sector has expanded into various areas like mobile banking, insurtech, and DeFi.

The COVID-19 pandemic highlighted the resilience of fintech, accelerating the shift towards digital financial services and showcasing the industry’s adaptability. Today, the UK fintech sector is at the forefront of innovation, driven by advancements in AI, blockchain, and financial inclusion.

Looking ahead, the future of UK fintech is bright, with expectations for continued growth and technological advancements. The collaboration between fintech firms and traditional financial institutions will be key to shaping a secure, efficient, and inclusive financial landscape.

In essence, the UK’s fintech industry exemplifies how technology can transform financial services and points to a future of ongoing innovation and opportunity.

Get in touch with the top fintech app development company Techugo to convert your imagination into reality and donate your efforts to grow the fintech industry!

Post Views: 1,947

SA

SA

KW

KW

IE

IE AU

AU UAE

UAE UK

UK USA

USA

CA

CA DE

DE

QA

QA ZA

ZA

BH

BH NL

NL

MU

MU FR

FR