In the modern world, everyone uses their phones to complete jobs more quickly, whether online medicine purchases, food orders, etc. Investment management isn’t neglected. With just a few clicks, any person can start investing through the software for investing. The majority of smartphone users use at least one investment management application. This indicates the high growth of these platforms developed by Investment App Development Company.

Making winning investment through app development can be a profitable business. Micro-investing has become a popular choice on the rise. Even teenagers can take advantage of the market. The idea of passive income is increasingly appealing to young people, and parents have begun to give their children Apple shares as birthday presents. This is all feasible by investing in apps. This craze in the market for apps is evident. However, creating an investment application that can remain afloat in the fiercely competitive marketplace can be difficult. Before diving in, knowing the basics of investment app development is essential.

The following is a comprehensive guide to navigating the intricate world of investing app development in this article. Along with their associated cost and the process of developing an investment app and other aspects to consider

Let’s get started!

What Is Investment App Development?

The investment app development process involves creating a mobile app that lets buyers sell, buy, or monitor their investments. These apps can be essential platforms for buying stocks or ETFs or advanced ones selling sophisticated instruments to professionals trading. When using investment apps, customers can set up a simple account to invest as little as one dollar. Most investment apps provide education tools and resources that enable investors to learn more about investing and make sound portfolio decisions.

Brokerage firms, financial institutions, robo-advisors, and other latest technology companies typically provide these applications. Investment FinTech mobile applications offer an array of functions and features to assist people in managing their investment portfolios, trading them, keeping track of the market, and making educated decisions about investments. The goal is to make investing more accessible, user-friendly, and convenient through smartphones.

Why Should You Develop An Investment App?

The investment apps are helpful for investors and those looking to create an application. There are many benefits to investing in apps:

Also Read : How to Create An App For Trade Shows This is A Guide

1. Growing Market Demand

The market for apps that invest is expanding rapidly because of consumers’ desire for more accessible ways of managing their funds. Due to this market’s rapid growth and expansion, there appears to be plenty of space to start or expand companies. As a result, consumers are better equipped than ever to make the most of their financial destiny.

2. Enhanced User Engagement

Investment software provides a distinctive opportunity for customers to be involved with their investment portfolios through interactive and personalized tools. It offers live market information, tracking portfolios, and individualized investment guidance, dramatically increasing users’ engagement and happiness. If people are active on the web applications, they stand a better likelihood of growth over time and retention levels.

3. Increased Accessibility

The investment application makes investing accessible to more people and eliminates the requirement to join traditional brokerage firms. Investors can begin investing in small amounts and then manage their investments.

4. Ease Of Use

Mobile investment platforms were created to make reviewing your investment portfolio and performing trades easy. This process can be more straightforward than that of other brokerages, so beginners will not have difficulty finding the right place to accomplish their goals.

5. Low To No Fees

In the past, trading financial instruments online was accompanied by the payment solution of a commission. This can range from $5-$30, and some brokers charge that fee for assistance with trading. You generally don’t need to pay fees to exchange stocks or exchange-traded funds (ETFs) through a mobile-based app. However, some charge a cost for options contracts.

Also Read : Mobile Payment Solutions Driving Cashless Transactions in Saudi Arabia

6. Low Barrier To Entry

A few brokers insist on opening an account by making the minimum amount. On many mobile platforms, it is possible to open an account without a requirement for a minimum amount. Many investment platforms on mobile let you buy fractional shares. So you could purchase individual ETFs or stocks for as little as $1-$5.

7. Data Analytics And User Insights

Mobile apps for investing can collect valuable information on behavior and preferences in investing. The data you collect can be used to increase the functionality of your app, develop customized marketing strategies, and customize user experiences.

Types Of Investment Apps

Different investment app development types exist today, each with unique features that cater to various investment requirements. These are a few common forms of creating an app in the field of investment built by Trading App Development Company In UK:

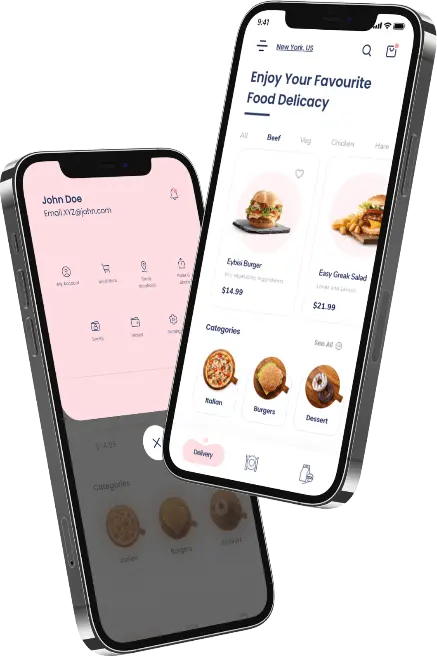

1. Stock Trading Apps

Stock trading apps allow customers to purchase and sell shares and other types of securities via their smartphones. They often provide real-time price information, market news, and trading tools that assist consumers with making intelligent financial decisions.

2. Robo-Advisors

Robo-advisors are investment software platforms that create and manage portfolios of investments based on the investor’s investment goals and risk tolerance. Exchange-traded funds (ETF) diverse portfolios are usually available, along with ongoing maintenance and rebalancing.

3. Cryptocurrency Exchanges

The advent of cryptocurrency trading applications enables users to trade digital currencies. The Android apps offer an easy user interface for purchasing, selling, and storing cryptocurrency.

Also Read : Cryptocurrency Wallet Development Doest Your Crypto Grwo in A Wallet

4. Peer-To-Peer Lending Apps

Investment apps that allow borrowers to connect directly with lenders, removing the traditional intermediaries in finance. The users earn interest on their investments by lending funds to small or individual businesses.

5. Micro-Investing Apps

Micro-investing Trading App Development lets users invest minor money by rounding purchases or investing any spare change. The aim is to allow investing in people with small capital by facilitating regular, small investments.

6. Retirement Planning Apps

These companies develop micro-investment apps that help investors organize and monitor their retirement funds. They offer tools to calculate retirement goals, monitor progress, and recommend investments that fit their needs.

7. Social Trading Apps

These platforms allow users to mimic the investing strategies of successful traders. Social interaction features often include following users, sharing insight, and discussing investment concepts.

Also Read : Stock Trading App Development Everything You Must Know

8. Education And Research Apps

The investment apps on the internet offer information on investing, market news research, reports on research, and analytical tools for financials. They aid users in making decisions regarding investments and market knowledge.

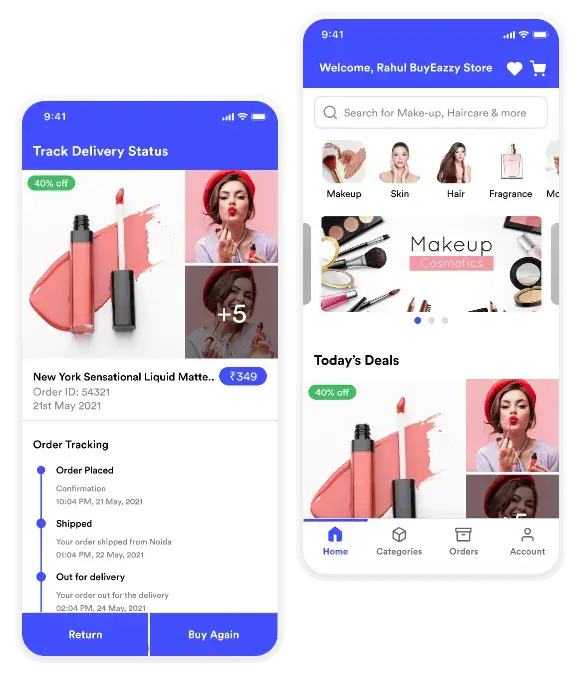

Important Features To Incorporate Into Investment App Development

Here, we’ve listed the most essential features to integrate into developing investment apps. Select the features that best fit your app’s goals and objectives. Let’s learn:

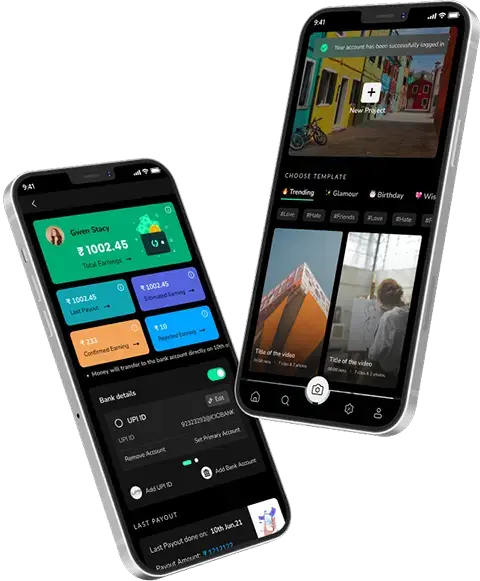

1. Login & Personal Accounts

A fully-fledged app for financial transactions, such as Acorns, which is user-friendly and built to convert, must be able to log in. What’s its purpose when you sign into the app and can’t make your account? A personal profile that has both primary and sophisticated options is required. The Acorns application can function as an individual office where investors can create an investment portfolio, monitor previous investments, and analyze the current business conditions.

Also Read : How To Build A Crowdfunding Platform Like Getstake in The UAE?

To avoid a negative impression, you should make signing up easy so as not to frighten investors. Also, you can offer the option of registering for social profiles to create accounts immediately.

2. Money Management Tools

Suppose you’re planning to begin an investment platform. In that case, financial management software has an exclusive place in the features list you must create. Why? Many people are looking for the best method to manage their money. Thus, offer highly effective dashboards to the people you want to reach with tools that can be used for savings, currency, and credit management.

To make the most of infographics such as interactive bars and pie charts. Every piece of content needs to be appealing to the eye and informative. It is essential to provide daily, weekly, and monthly updates to give users an accurate picture of your investments and financial operations. This is a fantastic option to boost the loyalty of your investor’s mobile application.

3. Security And Privacy Protection

Protection for the heightened is the most important regulation for any financial institution to adhere to within its investment apps. Constantly evolving technology fuels more sophisticated techniques for economic crimes. Be aware of the security of your data because users must ensure their personal information won’t be compromised while using your site.

4. Real-Time Analytics

Offer performance tracking and live analytics for investors. Help customers make informed choices and provide up-to-date information regarding key factors, such as market trends, portfolio performance, and other essential aspects.

5. Product Comparison

Instruments to compare investment options are a further important aspect in the list of characteristics of an online investment platform. Investors are cautious when choosing the right basket to put some eggs into. This reminds you that you are shopping. It’s impossible to return the money you paid if you don’t find a suitable item.

Customers need to see the differences and calculate the benefits and risks of investment goals. So, creating a separate section with various options where users set their requirements and evaluate alternatives could be straightforward.

6. Customer Support

The last item on the list of things to consider is client support. A positive shift from focusing on the customer towards a more business-focused approach allows customers to feel more committed and considerate. In the past, companies couldn’t show their innovative ideas for assisting clients when they were using call centers by everyone. However, there are various ways of standing out in the real estate market.

Also Read : Meet AI How To Boost Sales in Retail And Enhance Customer Satisfication

7. Push Notifications

In the trading world, real-time live information can be a boon. Customers will be delighted by built-in notifications regarding their favorite instruments and the latest news in the market. Sometimes, future customers might want to buy shares with exact costs, and push notifications is an excellent method to help these users. You can also inform your customers when significant developments occur in the market, like a correction in interest rates.

8. Calculator For Investments

It is a complex process that involves taxes, fees, and regulations. Your job is to help customers figure it all out by creating an app that incorporates a calculator. You can add value by integrating features like forecasting profits and planning investments.

9. Transaction Management

Offer features to make transactions secure and straightforward. Provide users with complete data and reports to keep track of the withdrawals, deposits, and the history of transactions.

10. KYC And AML Integration

Integrate Know-Your-Customer (KYC) and anti-money laundering (AML) procedures to confirm the user’s identity and prevent fraud. Be sure to follow the rules to ensure the platform’s integrity.

11. Virtual Advisor

If your service doesn’t depend on automated investments, your customers would appreciate having a built-in digital advisor. Create a chatbot powered by AI for a more pleasant customer experience. The virtual advisor can assist in solving a range of issues. For example, they can assess a user’s risk tolerance and investment objectives and provide a low-cost investment option or solutions if necessary.

Also Read : Healthcare Chatbots Promising A Patient Care Industry Transformation Or A Failure

12. Electronic Wallet

It is where funds for future investments are held. Two main requirements are safety and easy accessibility by a qualified person to manage the wealth stored there. A good investment app for online use will be able to link to both credit and bank card networks to get timely updates and secure the user’s data over the telephone.

Also Read : How To Develop Wallet Mobile App?

13. News And Social Feeds

Incorporate articles and social media feeds to notify clients of the latest trends in markets and financial news. Allow users to join in discussions, listen to experts’ opinions, and remain updated with current trends in the market.

How To Develop a Mobile Investment App?

A financially solid app is essential for users’ growing expectations and demands. A user-friendly and efficient app must follow a structured strategy to remain relevant or better than the competition.

1. Plan

It would help if you took the time to think about and design the app you plan to develop. Now is the time to ask yourself questions about your business’s ambitions. Is your business actually in need of investing in app development? What benefits and improvements can you expect? Are you sure this is the most effective strategy for your business growth? Assess your business’s willingness to accept the possibility of risk in various situations when something goes wrong.

2. Establish Business Model

The business model should be created at the time of the financial plan. What is the price of your services? What percent of your revenue do you expect to get? Let’s consider Acorn as an example of a platform for investment review. To use their services, users are required to pay one dollar each month. Additionally, the service allows users to make money out of transactions through pocket money and suggestions.

3. Comply With The Law As Well As The Rules And Regulations

All laws and regulations applicable to your business operations in the country where you intend to do your business must be followed when creating your FinTech application. Your users privacy might be subject to the laws and laws (such as the GDPR) and for your business operations.

4. Know How To Comply With Compliance Regulations

Before beginning the app design and development of the investing app, it is essential to know the regulations and laws in the region. Every nation has its regulator, which sets rules on the web and the financial markets. However, the fundamental frameworks have a lot in common. They are most often related to end users’ privacy, intellectual property marketing and advertising, and detection of money laundering.

5. Find An Agency For App Development

To select a Fintech App Development Company to develop an investment application, we suggest starting by looking through the list of portfolio companies. A company will likely have already created various investment apps on the iOS and Android platforms. Could you take note of their reviews? These reviews can help set expectations for app development companies.

6. Design The App

Start the development of your app with the company that developed your software. This involves creating an MVP to create the most effective mobile app for investing. The ability to enhance functionality is available when your app is equipped with only the minimum features required to run. For instance, you could consider investing in next-level security, including games and upgraded UI/UX elements.

7. Improve And Test

An MVP is in place, and programmers and QA engineers constantly test and improve the application’s capabilities before releasing every feature according to their priorities. The process concludes with an app that is offered for sale and download.

Also Read : Benefits QA Outsource Can Offer To Your App Products

8. Maintain The App

The app must keep most current functions up to date and create new features. Maintenance, including updates to use the newest operating system versions library, third-party service updates, and many other things, usually consumes between 20% to 50% of the initial budget for the app each year. To avoid security issues, you must upgrade your libraries and frameworks to the latest versions. In addition, you should regularly test your application for speeds and security flaws.

Also Read : Maintain Botany At Your Fintertips With Plant Identification App Development

How Much Does It Cost To Develop An Investment App?

An investment app’s development is priced between $70,000 and $120,000. It is possible to use the money to upgrade features essential to allow you to purchase or sell assets, track data, and send notifications to alert users about crucial happenings. The features of advanced investment apps can be integrated into higher-end applications and cost double.

Cost to develop an app can be affected by several variables. In-house teams can cost more than outsourcing the entire project. The development cost is determined by the location where the developer will be hired. Outsourcing is generally the preferred option since the developer pays reasonable hourly fees.

MVP is the best option if you’re looking to develop a cost-effective investment app. In this case, you’ll create your investment app with simple or minimal features and capabilities in the marketplace. This will allow you to gain insights, identify essential areas of improvement, and evaluate the market well.

Also Read : Supercharge Your Startup How MVP is Your Secret To Rapid Success

You can use an entirely developed app after you’ve reviewed your app and the competitive landscape. Contact investors and present your idea for funding to build your fully-developed investment app. The MVP method helps you concentrate on your core offering, reduce work, create strong connections with clients, and increase the effectiveness of your online business processes.

Monetization Strategies To Generate Money From Investment App

Implementing monetization strategies in your investment application is essential to making money. Below are some of the best ways to make money that you can apply:

1. Advertisements

Partnering with financial institutions to show website advertisements can boost your application’s revenue. This can include promoting or adding financial services to complement your app’s services.

2. In-App Purchases

When users become accustomed to the program and its layout and become more comfortable with it, they may seek new capabilities and more control over their investment. However, the additional features come with an expense.

3. Subscription Fee

It is a different monetization strategy that can generate revenue for your application. You can provide the best features with subscription plans. The features include trading options. Users are offered advanced analytics, trading options, and personalized financial guidance.

Required Team For Successful Development Of Investment App

A team of app development experts in various fields to create an investment application. The following are the most important tasks you should have for your team members:

1. Project Manager

The person in charge oversees the design process and manages resource assignments, deadlines, and budget. They are responsible for open and transparent communication with the team members, monitoring the project’s development, and dealing with any issues that may arise to ensure effectiveness.

2. Business Analyst

Study the market and determine where the user must define the intended audience and the application’s capabilities. Members create technical specifications when designing UI/UX to ensure the application meets users’ needs.

3. Mobile App Developers

Programmers are experts in particular programming languages. They create an app’s core functionality, including a front-end interface and back-end logic, to ensure an enjoyable app experience. The developer is also responsible for integrating APIs to market feeds, payment gateways, and financial information.

4. Back-End Developers

They excel at developing server-side applications that rely on techniques like Python or Node.js to manage data processing, security, and user account management. They also provide perfect data storage in databases such as MySQL and PostgreSQL.

5. Security Engineer

The team takes strong security measures that protect users’ information, secure transactions, and financial data. Additionally, they ensure that the company complies with applicable legislation and regulations regarding financial transactions. Security engineers perform tests to identify weaknesses.

6. UI/UX Designer

The developers design the app’s UI to be intuitive and easy to use. They develop prototypes and mockups for user feedback and refine the layout in response to user requirements. Designers ensure users have a pleasant and consistent experience on every device.

Also Read : Virtual Reality Mobile Apps UI/UX

7. QA Testers

They perform rigorous tests during app development to identify and correct issues and bugs. They also test the app’s quality, safety, compatibility, and performance on a variety of operating systems and devices to ensure that it will deliver a flawless and fault-free user experience.

The amount of detail in the investment application you plan to create determines the number of team members you need. Hiring a mobile app development business with a proven track record in fintech payment app development is possible.

Investment Apps Market Trends 2024

Investment applications have evolved into essential tools in today’s constantly changing investment market that benefit new and experienced investors alike. The user-friendly interfaces, the customized opportunities for investment, and smooth interactions with financial instruments are growing on the market. The apps that offer convenience and accessibility that are unlike anything else are changing how people deal with their money due to the rapid growth in technological advancements in finance.

Democratization Of Investing Via Inexpensive Channels

Investing applications are revolutionizing market access. In the wake of fractional shares and trading with no commissions, the cost of entry is being cut. This makes it possible for younger investors—especially young adults—to trade in the market, regardless of their account size. Traditional brokers are expected to be able to reduce costs and stay efficient.

Automation And Personalisation Driven By AI

Artificial Intelligence (AI) is used in investment apps to customize users’ experience. To recommend suitable investments and automate the process of investing, AI algorithms examine market fluctuations, risk tolerance, and investment objectives. The system provides advice tailored to new traders and advanced tools designed for experienced traders that cater to investors at all levels.

When AI technology advances, we can expect more sophisticated and personalized personalization and the possibility of robo-advisors. It supervises entire portfolios based on the user’s chosen guidelines.

Combining Socially Responsible And Alternative Investments

There are many more investment applications than bonds and stocks. These mobile apps are taking on fractional ownership of art, property, and venture capitalists in light of the increasing popularity of alternative investment. Portfolio diversification is a goal for investors; this new trend can yield higher returns. Today, investors can align their financial goals with ethical values by filtering and choosing assets according to sustainability and moral norms.

Conclusion

Financial technology (FinTech), including investing apps, can be an excellent choice for people looking for a cost-effective, easy, and personalized method of investing. In the same way, the investment management option could be the better option for those looking for the highest level of service.

Making an investment app might appear easy, but it can be tricky. Consider every aspect, feature, stack, and functionality to ensure your application is at the forefront of trending technology. To make your app more profitable and keep pace with your expected return on investment, hiring an investment company for app development is recommended. They have the necessary capabilities and knowledge to carry out the project.

Get in touch with Techugo to develop smart, efficient, and user-friendly investment apps tailored to your needs. Harness cutting-edge technology and innovative solutions to create a seamless user experience. Our expert team ensures top-notch functionality, robust security, and engaging design, driving your app’s success in the competitive market. Let us turn your vision into reality and set you apart from the competition.

Post Views: 1,913

SA

SA

KW

KW

IE

IE AU

AU UAE

UAE UK

UK USA

USA

CA

CA DE

DE

QA

QA ZA

ZA

BH

BH NL

NL

MU

MU FR

FR