Are you planning to create an app? You would like it to be the most life-changing application available on the App Store or Google Play Store. But then you realize that you’ll need funds for this to happen. What is the next step for you to convince the app’s investors to help bring your fantastic idea to fruition? With 88% of all mobile time used for applications, it’s no surprise that many companies are interested in working with an experienced mobile app development company.

The fact that you have a revolutionary concept for an app to launch your business may not be enough. However, getting funds to develop your app is not easy. So, locating investors to fund your venture would be best. Before you present your app or business idea to investors, do some initial study. If your concept is innovative to investors, they will likely decide to invest. Apart from that concept, offering your MVP without features allows investors to examine and test your service in real-time. Investors will see the seriousness of the product, and they will be more inclined to invest in it.

Follow this comprehensive guide to funding your mobile app. You’ll be able to present your idea to investors and bring your concept into existence.

Who Are The App Investors?

App investors are people or groups of people who have funds to fund the growth and development of apps. App investors can be found with a myriad of names. The price of developing an app ranges from $16,000 to $72,000. In addition, hiring a developer may exceed $100k. It is crucial to go through several development and financial steps to raise this kind of capital from investors in apps. Apps with an MVP are more likely to attract investors from larger app companies with a working, functioning MVP that they can test. In contrast, those with early-stage app ideas might require many iterations and loaned investment before they’re ready to prototype.

Also Read – Fintech Special: How to Get Your Investor’s Attention?

However, the idea of an app takes off very rarely without the support of app investors. The failure rate of SME companies across the USA is very high. Only 35% of startups have a lifespan of longer than ten years. This makes it crucial for app developers to know how to obtain the money needed to develop their apps.

Types Of Investors

Before you begin looking for investors for application development, it is important to know the types of investors in the finance industry nowadays. Investors are needed at virtually any stage of a startup.

Below are the top categories for investors and suggestions on the best time to consider them. Suppose you want to raise funds to start your business. In that case, you can talk to potential investors below to help develop your mobile app.

1. Personal Investors

Most investors in startups in their early stages are typically relatives and friends. Therefore, as entrepreneurs, you can depend on your family, friends, or close contacts to fund your startup, particularly in its early phases. Personal app investors might be able to ask for equity investment. Plus, they could invest their funds into your idea because they are convinced of the vision and you.

However, the number of people in your network who can invest in startups is limited due to legal restrictions. In addition, while convincing your friends and family to support your startup might not be complicated, extensive documents are strongly recommended.

2. Peer-To-Peer Lenders

Peer-to-peer lenders are individuals or organizations that provide funds to startups. This way of obtaining capital investment can also be referred to as crowdlending. The lenders connect entrepreneurs for the loans they need directly through an online portal. To get funds for your business, you must apply for peer-to-peer loans. This option can be a good alternative if you require funds to start your business but cannot obtain a bank loan.

3. Angel Investors

Angel investors can also be referred to for their role as seed investors. The high net-worth investors make early-stage ventures to acquire some equity. The majority of angel investors work throughout the entire industry. Therefore, angel investors can be located to develop apps. Generally, angel investors invest to earn a profit when the business grows and the value of its stock rises. They not only give financial aid to startup businesses but also provide information and networking opportunities.

Angel investing could be advantageous for you if you’re at the initial stage; however, you’re not prepared to pursue the help of a venture capital fund. The right business foundations, a good idea, and an effective presentation are just a few elements that make it attractive to investors.

4. Banks

The bank loan has been a reliable source for startup finance for years. Getting the bank loan option for smaller firms is possible since taking out loans can give you greater control over your business’s finances. Numerous financial institutions and banks provide loans with low interest to entrepreneurs just starting. Before a loan request is approved, you might require proof of collateral or evidence of income.

Also Read – How to Create a Money Lending App: Funding the Future By Making Lending Easy!

While the loan isn’t nearly as big as the money offered by angel investors, it could be a great beginning if you feel your business’s operating profits will be enough to support itself over the future or you’re looking to kick-start your business until you can secure additional funds through an angel investor.

5. Venture Capitalists

After a mobile app launch generates substantial revenue, it can turn to venture capitalists or companies. These are crucial because they usually offer significant funding for mobile apps. Venture capitalists are corporate or high-net-worth individuals who invest in startups early to receive a percentage of their stake. The financing offered by venture capital is focused on those who have demonstrated the most innovative ideas for business and the need to be there.

In addition to investing in the development of apps in terms of money, venture capitalists and venture capital companies can offer direction and guidance for the technology firms they invest in and participate in making decisions. A few tech companies can secure funding from venture capitalists and venture capital companies. Venture capital funding can be lengthy because it requires numerous evaluations from investors interested in the app’s idea.

6. Incubators & Accelerators

Accelerators and incubators offer vital assistance in raising substantial money for your startup app. Business incubators are non-profit organizations that can assist you with developing your app idea. They will help you manage your startup’s growth over time through assistance in the fields of infrastructure, networking, manufacturing, advice, education, and coaching. Though utilizing business incubators as investors in mobile apps isn’t a convincing argument, they can certainly help you save money, particularly when it comes to tech companies at their earliest stages.

In contrast, accelerators are businesses for profit that offer fixed-term, group-based programs based on mentorship that include seed stage funding, networking, and even training. Accelerators are paid a portion of the equity stake to provide their offerings. Most entrepreneurs favor seed accelerators over angel investors because they provide more than seed-stage funding.

7. Crowdfunding

Crowdfunding is an incredibly new method for entrepreneurs to raise funds for their business startups. Funds can be raised by launching a campaign for funding through one of these crowdfunding sites that allow a massive crowd of app users to fund your app. An added benefit is that reducing your owner’s equity is not required.

Also Read – A Technical Guide for Crowdfunding Software Development!

Investors can invest in your business to gain something in return, typically the opportunity to access your app in the early stages before its debut in the marketplace. It is also possible to make a Minimum Viable Product (MVP) version of the app so they can provide feedback. You can alter the investment required to start your business and the various incentives investors receive.

8. App Contests

App contests are organized worldwide through business incubators like Y Combinator. Although highly competitive, contests allow entrepreneurs to pitch their ideas to the business community and investors. Venture capitalists and investors usually decide on the winners of these contests.

The funding provided by app contests can be compared to angel funds, as the prizes offered in-app contests provide funding to develop an idea. Although your idea may not be able to win the award, this contest allows you to present your ideas in the eyes of potential investors and establish relationships with them.

9. Personal Network

A look within your networks is another excellent method for gaining initial funds to develop your app. Your family and friends can be a good first step; however, you must expand beyond your circle of friends and family. Look at weak connections to your network (professors, former colleagues, or bosses.) Consider if they might assist you.

Better yet, please find out the people they are friends with. A weak connection may have a friend who could help or know someone who can make a recommendation. If you’re using your contacts, it’s all about relationships that may aid you when bringing your app into existence. Strategies to earn the trust of investors in developing mobile applications

Also Read – Step-by-Step Guide for Mobile App Development Process

Methods To Win The Trust Of Investors

An app that is just a base idea doesn’t help investors as they want proof that you’ve considered your idea. Investors want to prove how you’ve analyzed the competition and that your app could succeed in the marketplace. The following are essential steps to help you win investor trust as well as get funds to fund your innovative concept:

1. Test Your Concept

Deciding on a new idea can be overwhelming. Thinking of concepts that will help solve customers’ issues is essential. It is possible to begin with your areas of interest or passion. When you’ve come up with an appealing mobile app concept, the next step is to test it to ensure that it’s a viable idea. Investors won’t be interested in funding the same idea already in existence.

Therefore, a thorough market study should determine the competition in the app’s marketplace. Be sure your idea isn’t the same as another business’s offerings. Also, you can consult with an app development company to better understand your concept’s potential.

2. Discover The Best Market

It is crucial to know the competitive landscape in the marketplace. You must conduct extensive research about the applications available within your area to determine the most innovative functions they offer users and ways to keep ahead.

3. Determine The Size Of The Market

In studying the environment of competition, you will understand the market size it is possible to expect, the intended audience, and the percentage of the market. This will allow you to provide those who could be your mobile app’s users with figures on the potential risks and opportunities to be prepared for.

4. Choose a reliable App Development Partner

Finding a reliable application development partner will help you turn your ideas into reality. a Successful business that has successfully executed similar projects and successfully executed similar projects and projects delivered comparable products. Mobile app development companies have a team of experienced developers, UX/UI developers, and marketing specialists who offer expert advice and consider your ideas.

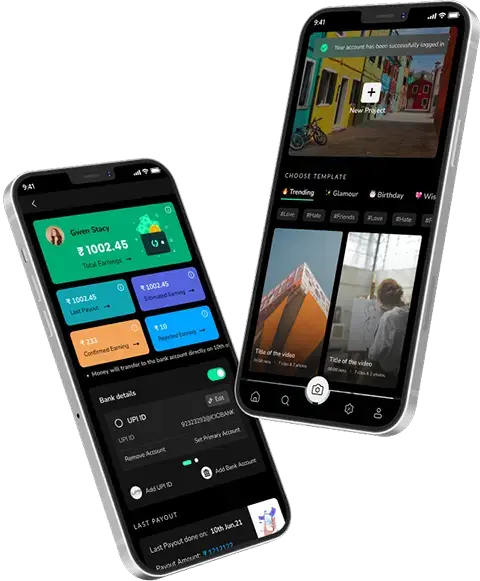

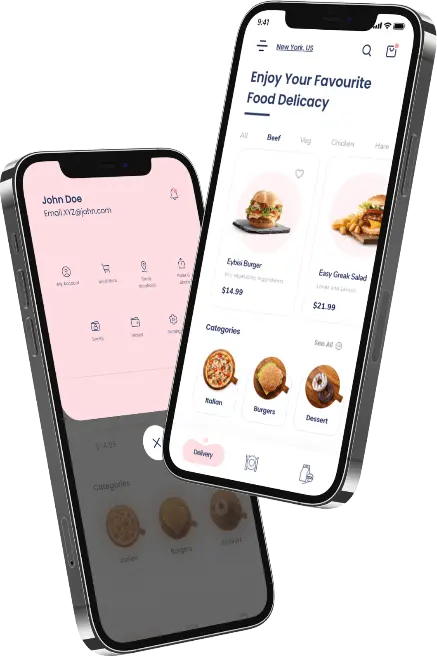

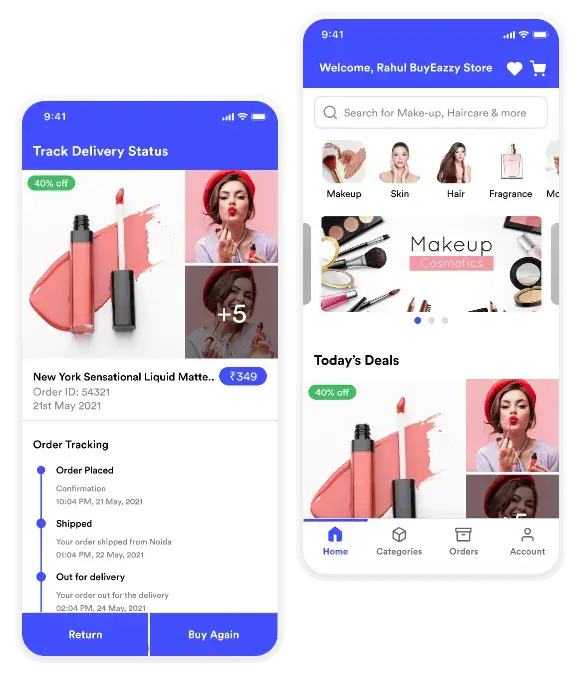

The business also offers up-to-date industry knowledge and access to the latest technology. This helps you develop an updated app with functions and features that can surely attract investors. Thus, working with a trusted mobile app development company in USA is the best option if you are looking to secure investment from investors.

5. Learn The Basics Of Investing

To earn investors’ trust and convince them to invest in your business. For that, you must know the basic principles of operating your own business and raising money. This will enable you to comprehend the kind of capital you need to increase and the various stages of investing currently in operation.

6. Determine a Revenue Plan

A clear and straightforward strategy provided to investors can help them fund the development of your mobile application more than they would otherwise. Therefore, if you’re considering the best way to make money with your idea for an app, you need to research the different monetization methods and be prepared to respond to concerns about them.

7. Create MVP

Minimum Viable Product or MVP is an app’s initial version with a set of functions. It’s a cost-effective and cost-effective method of helping investors comprehend the process of your application. An MVP lets you determine if your app can be expected to be successful before introducing it to investors in the app startup.

Additionally, MVP provides potential investors with a real-time product they can view and interact with. A potential investor would rather have nothing less than a working organization with owners who have poured their time and personal money into the business. The MVP is extremely flexible, so you can keep tweaking it until you get the perfect reaction. If you want to achieve success with MVP development, contact us.

8. Prepare a Presentation

Once you’ve figured out how to get investors interested in your app’s development, it’s essential to think about the best way to go about it. Create your presentation deck. Make sure you fully understand the entire process of starting your business, and then be ready to make it clear even if you don’t have slides. Also, anticipate potential investors’ inquiries about your app on mobile. The key to success is trusting in your concept application, pitch, and deck.

Understanding The Funding Rounds

When you’ve completed the work of figuring out the flaws in the idea for your app, you’re presenting your idea to a group of investors. Most companies or startups have to go through many types of financing rounds. Knowing what a round of funding means to your business is crucial.

Each time you fundraise, you’ll meet various investors with different goals regarding where they’d prefer to invest their funds. Funding rounds enable your startup or application to experience many iterations and milestones in making improvements.

1. Pre-Seed Funding Stage

The term “pre-seed” often refers to the period the app has its operational operation. The timing to obtain startup financing for your project depends on the kind of startup and the costs involved in developing your app. It is also known as the stage before seeding. For a different way of thinking, “scaling” your startup refers to using your existing resources, including your savings.

The pre-seed stage allows tech startups to swiftly produce and disseminate their apps. Entrepreneurs usually evaluate whether their ideas are viable during the market research or design stage. They may already have developed a working prototype for the app and are looking for funds to grow their business.

Most entrepreneurs seek the advice of their company’s founders, who have had the same experience and gone through the same experience as their current. They can estimate the expenses of their concept, formulate an effective business plan, and think of ways to transform the idea into a profitable company.

Also Read – An Entrepreneur’s Guide To On-demand Alcohol Delivery App Development!

During the pre-series phase, the entrepreneurs must sort out the required partnership agreements, copyrights, or any other legal matters because the best way to resolve compliance concerns is now. In the absence of this, these issues could end up being costly or even prohibitive later on. Additionally, investors will not support a business with legal issues before its debut.

2. Seed Funding Stage

It’s time to start planting the seeds following the pre-seeding phase. The seeding stage can be compared to planting trees. The startup money through the seed round is theoretically the “seed” that enables every startup app to expand.

Continuing to invest in the venture could prove risky. Therefore, entrepreneurs can reach out to investors. Investors face huge risks when they invest in startups, and entrepreneurs offer the investors equity as seed capital. There are more significant risks as entrepreneurs aren’t able to ensure a business plan that will be successful during this time.

The capital from the seed round allows an entrepreneur to finance the cost of developing apps, gain early recognition via marketing, hire employees, and carry out additional market research to ensure that the product is market-ready. Many companies think that a seed round will be the only thing they require for their venture to get up and running.

3. Series A Funding Stage

The first phase of venture capital investment is Stage A. At this point, the startup is running an operational app and an ongoing flow of funds. Now is the time to seek series A funding and enhance the business’s value proposition. Business owners often develop innovative app concepts that could attract many users. However, they’re still determining which way to make money from their ideas in the future. Therefore, it is crucial to plan to prepare for the Series A investment round to generate income in the long run.

Now is the best time to study startups and establish relationships with angel investors and venture capitalists. Find app investors keen to invest in your company using the 30-10-2 approach. This law states that you need to locate 30 investors who are interested in investing in your business.

Venture capitalists at the early stage and angel investors are the primary sources of Series A investments. They’re not seeking “amazing app ideas”; instead, they are looking for companies with an established business plan that could transform their incredible concept into a profitable company that makes profits from investors’ investments. An investor may act as an anchor but after the startup has enlisted the first investor, it will be easy to find investors later.

4. Series B, C, and D Funding Stages

Startups for app development that made it through previous phases of financing could build large numbers of users and an ongoing stream of income. They could have proven to investors that they can achieve tremendous success on a more significant level. The Series B stage permits app startups to grow to meet the various needs of their clients while battling with other companies in a competitive market.

Also Read – What is an Elevator Pitch? Mastering Startup Funding with a Compelling Pitch

A new generation of venture capitalists has entered stage B of the series. They specialize in investing in established companies to ensure that they continue to surpass expectations. App startups that make it through the series C investment round are ahead of the curve to be successful. The app startup companies are seeking more funding to assist them in developing innovative apps, creating for other markets, and even purchasing other app stores that are not performing well in the same area.

Investors would instead fund successful companies in the Series C investment stage. They hope to earn an income more significant than the initial investment amount. In the Series C stage, several hedge funds, investment banks, and private equity companies can invest in these companies. In addition, entrepreneurs can find investors in a specific scenario at the Series D phase. Few startup companies need this phase, like a merger or a growth objective.

Series D capital can provide entrepreneurs with the most feasible choices, allowing them to tackle issues head-on through a merger with another startup. Additionally, suppose a company is not able to meet its goal of growth through series C financing. In that case, it must find additional capital using Series D financing to remain on the right track.

How Much Fund Will You Require For App Development?

Suppose you’re wondering about the cost to develop a mobile app. The precise amount will be contingent upon your app’s concept, the application’s difficulty, your team’s capabilities, and other aspects. A simple MVP featuring a few features may range from around $15,000 to $50,000. More complex cross-platform apps using APIs, on the other hand, will range from $50,000 to $200,000.

Also Read – How Much Will Mobile App Development Cost in 2025?

However, don’t worry about it, as we’ve discussed how to raise capital for your startup. Before you go to the investors in your app, you should work with your complete-cycle firm for app development to figure out the approximate cost of creating your app, its features, and the primary goal of the application. Without a budgeting plan, you risk making a financial mistake that could ruin the opportunity you’ve always wanted.

If you get less money, you’ll be unable to start the development process. In contrast, if you can receive more outstanding funds than you’ll need, you end up offering your owner’s share or your business to mobile app developers.

What Should You Do After Receiving Funding For Your Application?

After you’ve gotten funds from investors, how do you go to the next step? The work you’ve done doesn’t have to stop there. Your app requires continual enhancement and upkeep. When your app is released, keep improving it and solicit the feedback of users and investors as you expand. When you progress through the different stages of starting financing, your company will be able to receive funding that could be utilized to create new features for your application.

In addition, due to the introduction of technology advancements and new features on OS apps, your application is bound to change continually. This is why hiring an experienced startup company for app development is essential to ensure the running of your app over a lengthy period.

Things To Consider For Early Access Funds From Mobile App Investors

This is the entire checklist you need to think about when fundraising.

- Ensure your data is correct and robust enough for the app’s launch.

- Consider where you will be raising funds, irrespective of whether you’re soliciting funds from overseas or seeking local investors.

- Are you looking for angel investors with more freedom or venture capitalists who have an established procedure?

- Ensure you know the exact time of year when you decide to donate. It will be long, especially in the days before Christmas.

- Ensure you review your elevator pitch several times before preparing to present it to the investors. Spend more time preparing your best pitch.

Conclusion

Many mobile app startups need more capital to succeed, and getting investors is sometimes challenging. Following the proper methods and executing them promptly can help you find the appropriate investors to fund your app. The key is to show your idea and pitch your concept to market movers and shakers as they choose to invest in the most innovative ideas.

Keep in mind that app development isn’t just a once-in-a-lifetime activity. It’s a continuous job. It is essential to update your application with fresh capabilities and new features at regular intervals to keep users engaged. Be patient because it can be a challenging and lengthy process, but with the proper approach and preparation, it could lead to countless growth for your company.

As you embark on your app development journey, Techugo stands ready to be your trusted partner. With a proven track record of success and a team of experienced professionals, we offer comprehensive app development services tailored to your specific needs. From ideation to launch and beyond, Techugo provides expert guidance, cutting-edge technology, and unwavering support.

Get in touch with Techugo and experience the difference. Let us help you transform your app vision into a reality.

Post Views: 1,630

SA

SA

KW

KW

IE

IE AU

AU UAE

UAE UK

UK USA

USA

CA

CA DE

DE

QA

QA ZA

ZA

BH

BH NL

NL

MU

MU FR

FR