Go for online transactions for a smarter and safer society!

Online Payment apps have become popular over the past few years and have transformed how we transact and deal with money. No matter whether it is for payment of bills, remittance, or purchase, these apps have gained a prominent place in our lives. An example unique to the Middle East is ZainCash, using eWallet and payment app solutions in Iraq and Jordan primary. As the number of mobile payment service users has grown recently, many people who want to be business owners or business managers are interested in developing such apps. However, a common question arises: Fintech app development company opened the door to this type of service by launching the ZainCash mobile payment app. How much does it cost to build an app like Zain Cash?

In this guide, we’ll delve into the specifics of what goes into the cost of developing a fintech app like ZainCash. We’ll also discuss the benefits of partnering with a fintech app development company in the UAE, Saudi Arabia, or Dubai and how they can help bring your app to life.

Without further ado, let’s discuss the Zain cash app!

What is ZainCash?

ZainCash is an e-wallet and money mobile application that lets users manage their money, pay charges, transfer money, restock communication services, and purchase at outlets or online. This makes the app useful in areas where banks and ATMs may be scarce, as the user utilizes the app to transact cashlessly from Iraq to Jordan and overshadow regions without financial services.

Also Read – Why Fintech Payment Apps are the Future of Secure Transactions?

Thanks to its user-friendly, secure, and swift approach to financial solutions, ZainCash has emerged as a trusted name in the FinTech sector. These key features empower users to make seamless payments using a payment app like Zain Cash, instilling confidence and reassurance.

Connect with an app development company to make your app successful!

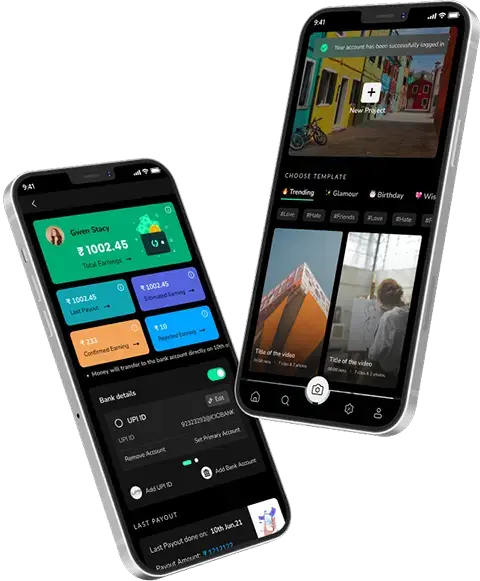

Check out the features of the mobile payment app!

Key Features of a Payment App like Zain Cash

To fully understand the cost of developing a payment app like Zain Cash, it is pertinent to know the features that make it famous. A fintech app development company will need to include these functionalities to create a competitive and user-friendly application:

Also Read – Mobile Payment Solutions: Driving Cashless Transactions in Saudi Arabia

1. User Sign Up & Login

This was followed by easy registration, which should be secure. The app should include features such as mail or phone registration, 2-factor Authentication (2FA), and linking with social networks.

2. Fund Transfers

An app like ZainCash works by sending and receiving money. Payments should be made within the app, directly to another user’s bank account, or via any other user. The ability to transfer money instantly or to split the cost helps make the app even better.

3. Mobile phone recharges and bills payments

Life also affords the client the luxury of paying the bills or topping up mobile services directly from the application, especially in regions where bank accounts are rare. Cutting down on the number of financial transactions in people’s lives is where ZainCash fits in by leveraging utility companies and telecom providers.

Also Read – Mobile App Development in the Middle East

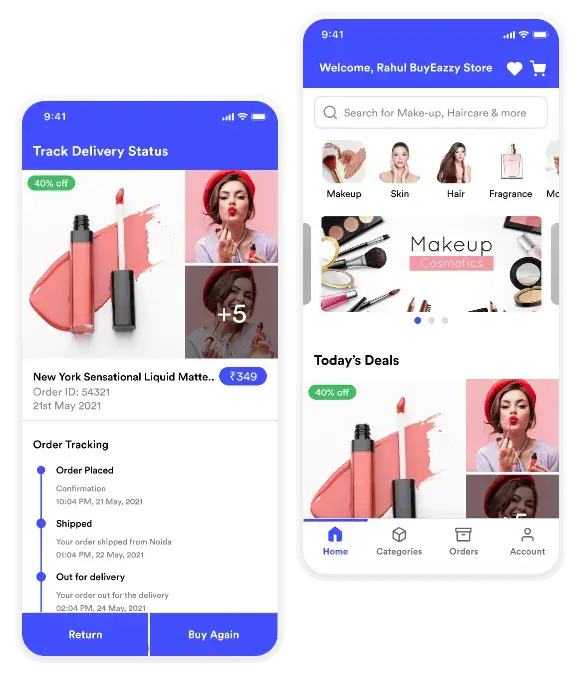

4. In-App Purchases & E-Commerce Integration

We need to save in-app purchases and e-commerce functionality for future chapters, as it would be confusing for a new reader to try and work out what is happening when it is mentioned throughout the chapter.

Some fintech apps, including ZainCash, link with e-commerce sites, and users can purchase from the app. Incentives help increase traffic.

5. QR Code Payments

One widely known use case in fintech applications is enabling customers to scan the merchant’s code to make immediate payment. This makes the app suitable for in-store and offline transactions, including shopping and physical face-to-face transactions.

6. Transaction History

A secure transaction history must be provided so that the users can review their usage history and even budget effectively for the future. This feature makes users comfortable and adds transparency.

7. Security Features

Due to the nature of the service, which involves financial transactions, the case of ZainCash must adopt high security. Some main areas include biometric authentication (fingerprint/face recognition), encryption mode, fraud detection, and real-time monitoring.

8. Currency Exchange

For areas with many local currencies, users can quickly move money from one country to another or change from one currency to another through a currency exchange profile.

9. Push Notifications

One of the essential applications of push notifications is to forcefully notify users of the kind of bills coming up, promotions, and any concerning account activity.

10. Customer Support

The opportunity to call customer service anytime and obtain prompt support within the app or through a chatbot will ultimately improve the user experience.

Factors Influencing the Cost of Building a Payment App Like Zain Cash

The price of developing an app in Dubai or other areas depends on the type of app, the development team, and the features to be incorporated. Let’s break down the most critical factors:

1. Mobile OS (iOS, Android or Both)

Another factor influencing the budget is whether to create your app for iOS, Android, or both. iOS apps are usually developed, require professional service, and cost more than the Android platform. That’s true, and if you are aiming to reach a wider audience, cross-platform development with the help of frameworks like Flutter or React Native can be cost-effective.

2. Origination and User Interface/Experience

Designing an easy-to-navigate and aesthetically pleasing app is mandatory for a fintech application. Using a professional app developer in the UAE or Saudi Arabia will prove beneficial as it will ascertain your unique application, increasing its chances of success. However, custom design costs more than standard templates or themes.

3. App Complexity and Features

The app’s complexity remains directly proportional to the cost of developing the app. For instance, adding layers such as QR code payment, support for multiple currencies, and real-time analysis would take more time and resources than a simple payment application with no other additional functionalities.

4. Backend Development

The app’s back end comprises the system that runs the whole system. Since a fintech app development company deals with operations involving multiple parties, including merchants and customers, and financial information, the database backend must be scalable to accommodate high transaction volume, secure for consumer and merchant data and information, and well-integrated with third-party API links to payment solutions, currency conversion, etc.

5. Third-Party Service Integration & API Integration

Therefore, utilizing the payment app with extra services like payment gateways, bank APIs, and fraud detection increases the development cost. The costs incurred in using such services remain relatively high, thus contributing to the general cost of the application.

6. Security Requirements

Safety is always a priority for any fintech or eWallet app. To guarantee the users’ information and transactions’ security, you must obtain the highest levels of data security, including data encryption, secure servers, audits, PCI DSS, and other compliance with necessary legislation.

7. Testing & Quality Assurance

One should always test his app on as many gadgets and operating systems as possible to ensure they run perfectly without any hitches or security threats. The more extensive the testing, the higher the cost. But when this is omitted, the following problems might arise later.

8. Development Team Location

Outsourcing development in-house team cost differs from one location to another. For example, the rate of hiring an hour by a mobile app development company in Dubai or UAE will be higher than in Eastern Europe or India. However, the standards of work and customer experience in the fintech market in the region may explain the higher tariffs.

9. Maintenance & Updates

As with all web applications, after the initial phase of development and release, ongoing work is done to maintain the app and deal with the issues one might encounter, such as bugs, add-on features, and security updates. As for the evaluation of costs and benefits, the first nine are one-time capital expenses, while the last one is a continuous expense.

Estimating the Cost of Building a Payment App Like Zain Cash

While the exact cost of building a fintech app like ZainCash varies based on the above factors, we can provide some rough estimates. Here’s a breakdown of the potential costs:

1. Basic Version of a Payment App

- Features: User registration, fund transfers, bill payments, fundamental security, and transaction history.

- Development Cost: $50,000 – $80,000.

- Timeframe: 3 to 6 months.

2. Mid-Level Payment App

- Features: In-app purchases, QR code payments, multi-currency support, enhanced security features (biometrics, encryption), and customer support.

- Development Cost: $80,000 – $150,000.

- Timeframe: 6 to 9 months.

3. Advanced Payment App

- Features: All primary and mid-level features plus AI-driven fraud detection, real-time currency exchange, advanced analytics, and integration with external services (banking APIs, e-commerce platforms).

- Development Cost: $150,000 – $300,000+.

- Timeframe: 9 to 12+ months.

These estimates include iOS and Android development, backend infrastructure, security measures, and design and testing.

The Growing Demand for Online Payment Solutions

The rise of online payment apps presents a lucrative opportunity for entrepreneurs looking to enter fintech. With the increasing reliance on cashless transactions, understanding the benefits of creating an online payment app can be a game-changer.

Expanding Market Potential

The mobile payment industry is witnessing unprecedented growth. As more businesses and consumers embrace cashless transactions, the demand for innovative payment solutions surges. According to recent statistics, the global digital payments market is expected to reach trillions of dollars in the coming years. This expanding market presents a significant opportunity for new entrants to capture a share of the revenue.

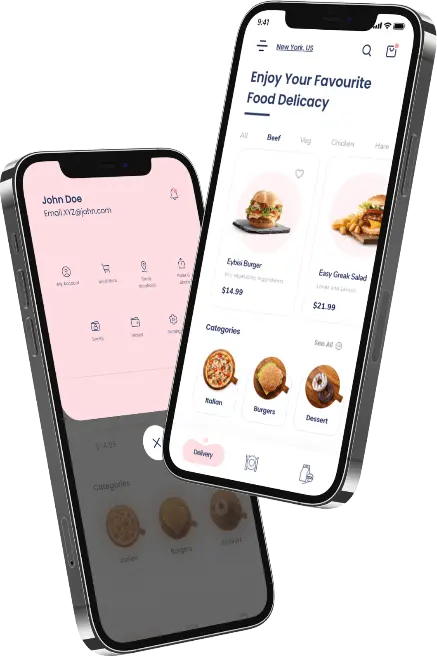

Enhanced User Experience

Today’s consumers prioritize convenience and efficiency when making transactions. By developing an online payment app, you can cater to these needs by providing a seamless user experience. Features like instant transfers, easy integrations with e-commerce platforms, and user-friendly interfaces can set your app apart and attract a loyal user base.

Increasing Adoption of E-commerce

The boom in e-commerce has further fueled the need for reliable payment solutions. As online shopping becomes the norm, businesses require secure and efficient ways to accept payments. By offering a payment app tailored for e-commerce, you position yourself as a valuable partner for merchants looking to enhance their checkout processes.

Leveraging Technological Advancements

Advancements in technology, such as mobile wallets and fingerprint authentication(Biometric), are reshaping the payment landscape. Incorporating these innovations into your payment app can enhance security and simplify the user experience. Staying ahead of the curve in modern technology adoption improves your app’s functionality and attracts tech-savvy users.

Explore the latest technologies for payment app development!

Main Technologies Used in Fintech or Payment App Development

Building a successful fintech or payment app like Zain Cash requires leveraging cutting-edge technologies to ensure security, scalability, and seamless user experience. Here are some of the leading trending technologies commonly used in fintech app development:

1. Blockchain

Blockchain technology revolutionizes fintech by providing secure, transparent, and tamper-proof transaction records. It ensures data integrity and enhances trust, especially in cross-border and cryptocurrency-based transactions.

2. Artificial Intelligence (AI) & Machine Learning (ML)

AI and ML are widely used for fraud detection, risk management, and personalized financial recommendations. By analyzing user behavior patterns, these technologies help improve security and offer personalized financial solutions, enhancing the overall user experience.

3. Cloud Computing

Cloud platforms like AWS, Google Cloud, or Microsoft Azure enable fintech apps to scale efficiently, store massive amounts of data securely, and manage heavy transactional loads. They also reduce infrastructure costs by providing flexible storage and computing resources.

4. API Integrations

Application Programming Interfaces (APIs) are vital for connecting fintech apps with third-party services such as banks, payment gateways, currency exchange platforms, and utility services. Open banking APIs also allow users to manage their accounts from various banks in one app.

5. Encryption & Data Security

Encryption technologies, including SSL/TLS protocols, ensure that sensitive user data and transactions are securely transmitted and stored. Compliance with security standards such as PCI DSS is critical to protect financial information from breaches.

6. Biometric Authentication

Fintech apps often use biometric authentication, such as fingerprint or facial recognition, to enhance data security and provide a seamless login experience. This technology ensures that only authorized users can access accounts, minimizing fraud risks.

7. Near-Field Communication (NFC) & QR Code Payments

NFC technology enables contactless payments by allowing users to tap their smartphones at terminals. QR code payments also allow for quick and easy in-store or online transactions, making these technologies essential for modern fintech apps.

Using these right technologies ensures that your fintech app can handle the demands of a dynamic, secure, and user-friendly financial ecosystem.

Let’s decode the trusted name in fintech app development for the Middle East!

Why Choose Techugo, a Fintech App Development Company in Saudi Arabia?

When developing a payment app like Zain Cash, working with a fintech app development company in the UAE, Saudi Arabia, or Dubai can be beneficial for several reasons:

1. Expertise in Regional Markets

The developers in these regions know Middle Eastern users’ requirements, tastes, and issues, which helped them design an application relevant to your targeted audience.

2. Focus on Security and Compliance

Developers of fintech apps in the UAE and Saudi Arabia are aware of local regulations like SAMA, which require that their applications adhere to the countries’ legal requirements.

3. Proven Track Record

Many companies offering Mobile app development in Dubai have developed payment and eWallet applications so that you can trust them.

Conclusion

Designing an app like ZainCash for payment solutions is exciting in today’s fintech landscape. Still, many challenges are involved from the ground up, and most importantly, the right technology partner is needed. Prices for application development will depend on the platform to be used, its design, necessary features, security issues, and further maintenance for applications in the regions, including Dubai.

You should collaborate with a reputable fintech app development company for many reasons. If you have a proper team and idea, your payment app can succeed in a world where more and more people are avoiding using cash.

Finding a reliable app developer to work on a payment app is one area everyone must notice with a concept to launch the mobile app. When launching an application in the Middle Eastern or global market, a competent team makes your app fit the fintech niche and other requirements, along with several legal compliances, considerations, and aesthetics that will attract the users. In the development and launching, you can create a tremendously competitive application for today’s mobile application market.

Get in touch with Techugo to learn more!

Post Views: 2,231

SA

SA

KW

KW

IE

IE AU

AU UAE

UAE UK

UK USA

USA

CA

CA DE

DE

QA

QA ZA

ZA

BH

BH NL

NL

MU

MU FR

FR