Blockchain technology has changed how transactions are conducted and how data is stored. Blockchain technology is often connected to cryptocurrency like Bitcoin, but its value goes well beyond the scope of it. Blockchain development services are helping pave the way for radical shifts across various sectors. As a top blockchain app development company in Fintech, this is why we know the revolutionary potential of integrating blockchain technology into financial solutions.

Blockchain’s immutability makes it an excellent solution for transparent and secure transactions. A forward-thinking blockchain app development company is aware of the transformational impact of blockchain technology earlier. They started harnessing its potential to develop innovative solutions that could increase the efficiency of various financial transactions.

According to Statista, digital peer-to-peer lending was valued at $3.5 billion last year and was expected to surpass $1 trillion in 2025. The gradual introduction of Blockchain into P2P lending platforms could facilitate safer access to money without the need to work with traditional banks. However, it is essential to utilize other blockchain functions to disrupt.

Just Read : Blockchain Application Development Ecommerce Industry

This blog will discuss how blockchain technology is changing the fintech industry. We will examine its benefits and possible applications in the finance sector. This blog is perfect if you’re a start-up or business owner trying to understand how Blockchain could improve your business operations. Let’s start by giving an overview of the market for Blockchain and fintech.

Let’s Begin!

What is Fintech?

Fintech is a term for financial technology, which refers to technological advancements within the financial sector. It includes various products and services that use digital platforms, information analytics, and sophisticated software to change traditional financial procedures.

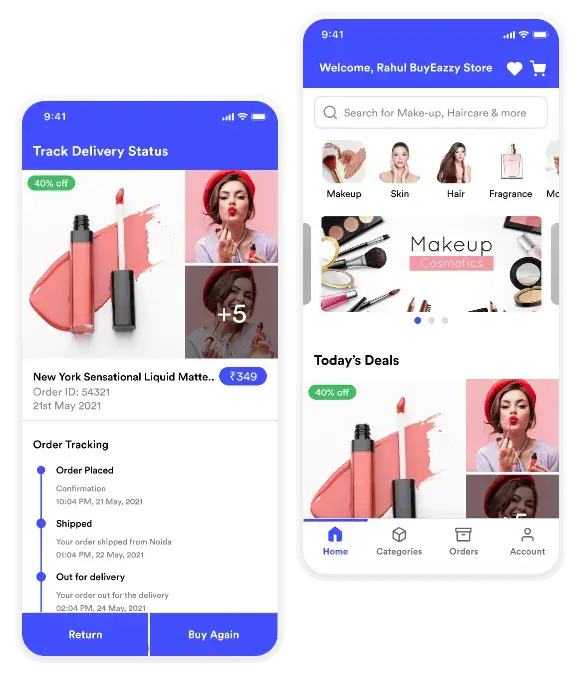

Fintech firms offer solutions in various sectors, including digital banking on mobile devices, payment and money lending, cryptocurrency, insurance, and wealth management. By streamlining their operations and enhancing customer experience and access, fintech has revolutionized the banking industry.

Also Read : AI’s Impact On Efficiency Risk Managment Risk Management And Insurance Software Development

Fintech speeds up transactions, encourages financial inclusion, and enables businesses and individuals to manage their finances better. Due to advancements in artificial intelligence, Blockchain, and online banking, fintech is constantly evolving, promising an improved future for financial services.

Optimizing Fintech Through Blockchain Technology

Despite many technological advancements, the financial industry still needs to be centralized, causing doubts about its effectiveness among people who use it. To counter this, Blockchain technology has emerged as a method of transparency, changing how fintech is conducted by providing the possibility of decentralization. This trend has inspired entrepreneurs and financial service providers to investigate the possibilities of Blockchain in changing the way that businesses operate.

Blockchain, an electronic ledger, functions as a decentralized database where cashless transactions are recorded transparently and securely on several computers. This ensures that no individual controls the information, growing trust and reducing the possibility of fraud.

Also Read : How To Develop An App Like Gcash To Buil A Cashless Ecosystem?

According to a 2017 report from PwC, fintech firms are increasingly recognizing the benefits of blockchain technology, with 77% expecting to embrace it by 2020. Furthermore, Forbes’ Blockchain 50 list reveals the considerable impact that blockchain technology is having on diverse sectors, including finance.

Blockchain technology has the potential to offer numerous benefits to the fintech industry. It allows faster and more affordable cross-border transactions, removes intermediaries, increases security practices using encryption and consensus mechanisms, and offers transparent and immutable records.

Also Read : Cloud Application Security Best Practices To Follow

Furthermore, Blockchain enables smart contracts, self-executing agreements with the contract’s terms directly encoded into code. Process automation decreases administrative costs and reduces the chance of disputes or mistakes.

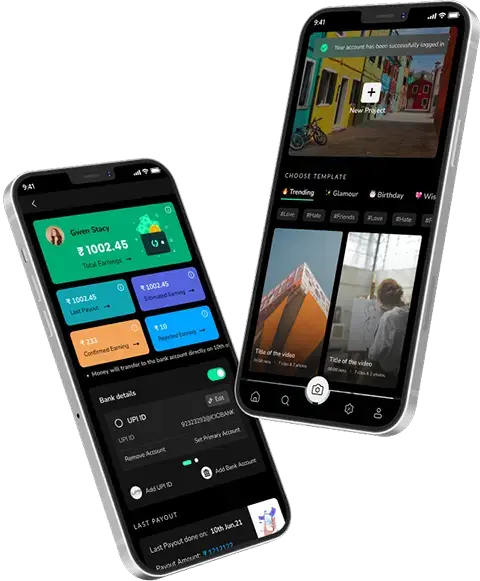

Finance app development company embrace blockchain technology to transform traditional business models and operating methods. This includes implementing blockchain-based payment systems, electronic identity verification, asset tokenization, and Decentralized Finance (DeFi) systems.

Ultimately, blockchain technology improves fintech’s efficiency, security, and transparency and reduces costs and reliance on intermediaries. As the fintech industry develops, it is anticipated that Blockchain will play a significant part in shaping its future development.

Rise and Future Growth of Fintech

The fintech sector has earned a spot in the top five fastest-growing fintech markets worldwide. In 2021, the Fintech market size was $50 Billion.

In addition, according to the report of Invest, the sector is predicted to grow to $150 Billion in 2025. With many people not having bank accounts, smartphone penetration, and government initiatives that support financial inclusion and digital payment, the sector has seen a rise. Furthermore, Fintech innovations have disrupted traditional banking by enabling easy payment, lending insurance, and services for managing financial information.

The future is bound to be incredibly exciting as fintech continues to grow into areas such as blockchain technology, AI, and open banking. Collaborations between fintech companies, conventional financial institutions, and emerging technologies will increase development, innovation, and financial empowerment.

Benefits of Blockchain in FinTech

The financial apps that use Blockchain provide many benefits that can transform how we manage our money. Here are some of the significant advantages of using Blockchain in finance:

1. Full Transparency

Blockchain is an immutable ledger. That means the public can view all transactions while preserving individuals’ privacy. Greater transparency into financial transactions increases trust and decreases the chance of fraud. Transparency also facilitates better regulatory compliance and increases accountability in the financial sector.

Also Read : Franchise Compliance Software Tools How To Choose The Right Solution

2. Full Privacy

Since the beginning, privacy has been among the most essential aspects of finance. While transactions are publicly recorded, individuals’ identities and sensitive information can be protected using pseudonyms or cryptographic methods. This permits safe and secure financial transactions and still benefits from the transparency offered by the Blockchain.

3. High-Security

The best thing about Blockchain is its decentralization, which makes it highly resistant to hacker attacks and data breaches. No single authority controls the ledger, making it extremely difficult for hackers to alter. Furthermore, cryptographic hashes guarantee that data is secure, and mutability stops unauthorized changes.

Also Read : How Dangerous Are Phishing Pharming Other Social Engineering Attacts?

4. Programmability

It lets you create smart contracts that automate agreements and transactions based on pre-defined terms. This removes the intermediary need and simplifies many financial procedures, like loans, payments, and trade finance. Smart contracts also help finance firms improve their accuracy by eliminating human error.

5. Scalability

Blockchain technology in finance can manage many transactions in a second in a single. As the network expands, the processing power grows, allowing it to handle more activity without sacrificing efficiency. Scalability matters to ensure the future growth of the financial industry.

Like AI in the development of fintech apps, which has introduced new ways to increase user engagement, blockchain technology is also changing the world of finance. Let’s talk about that in the next section.

Challenges Within the Fintech Industry that Blockchain Addresses

Problems such as missed targets, prolonged fundraising cycles, and growing losses are typical in the fintech sector and are usually caused by mismanagement. This is where a skilled blockchain app development company comes as an important associate. Here’s a list of problems blockchain technology could solve in the fintech sector:

1. Dependency on a Centralized System

While fintech products provide ease, the power remains in third-party organizations’ hands. The authorities control transactions in charge while users wait to receive confirmation of their transactions.

It is the first problem solved with the advent of blockchain technology in fintech.

2. No Trustability

Users who take action through fintech platforms must know what’s happening on the other side. This leads to confusion and increases the risk of identity theft, which, in turn, lowers confidence during the process.

Blockchain application development solutions help solve this fintech problem by its transparency and unchangeability.

Also Read : Mobile Banking Trends In The UK The Rise Of Fintech

3. Slower Processes

Another reason that fintech requires blockchain technology is because using different third parties is often a source of delay in the process. This results in lower satisfaction and greater volatility in the business world.

4. Higher Operational Cost

For those in the Fintech market, time is a significant factor. Therefore, by reducing the need for multiple people, making the process accessible to everyone, and decreasing the time needed to complete it, Blockchain technology has again been proven to be among the Fintech trends that can cut costs by more than 50 percent.

Contribution of Blockchain to the Finance Industry

Blockchain development solutions for the financial sector are multi-faceted, affecting a variety of elements of finance. Here are some of the areas in which Blockchain is making an impact:

1. P2P Payments

Bureaucratic obstacles characterize traditional banking, and inefficiencies often prevent payments and settlements from being processed. These obstacles are caused by obsolete banking practices and hierarchical structures embedded at various levels. Blockchain’s decentralization technology can provide a solution, using multiple consensus techniques to speed transactions and remove these issues.

Recognizing the many benefits of blockchain technology, such as efficient transactions and faster processes, financial institutions are now awakening to the possibilities of digital currencies. This paradigm shift is driving financial institutions across the globe to investigate the latest blockchain solutions. The goal is to break through conventional limitations to speed up the banking process and P2P payment methods.

A good example can be seen in the proactive approach of the Australian Securities Exchange. The success of a plan to move Post-trade clearing, settlement, and post-trade trading over to the blockchain system. This is an obvious move towards embracing Blockchain’s capabilities.

2. Trading & Trade Finance

Trade finance, estimated to be worth over $10 trillion by 2025, faces challenges such as manual processes and timeline delays. Trade finance still relies on paperwork, which means that share and stock purchases are subject to a complex procedure of exchanges, brokerages, and settlement. The whole process takes three days, and weekends prolong the time.

Also Read : Invasion Blockchain Technology Finance Sector

Blockchain adoption has opened new horizons, allowing for the automation of settlement processes, cutting down on transaction costs, and providing transparency in the regulatory process. As the industry embraces emerging technologies, it will alleviate the existing issues and create new revenue streams.

3. Auditing

Auditing in finance involves careful examination of financial statements to find anomalies. It is a crucial process that creates confidence and trust within the economic system. The process isn’t too complicated, but it takes enormous time.

With the help of a trading app development company, this procedure can be transformed into an effective instrument for sustaining the stability and integrity of the financial system.

Also Read : How To Create An App For Trade Shows This is A Guid?

4. New Crowdfunding Models

Crowdfunding campaigns often need to attract a wider crowd of potential investors, particularly those with geographical dispersion. However, costs for listing campaigns and processing transactions can cut into the project’s budget.

Blockchain is being integrated into finance through strategies like Initial Exchange Offerings (IEO) and Initial Coin Offerings (ICO). These can make fundraising quicker than traditional methods.

Also Read : A Technical Guide For Crowdfunding Software Development

5. Crypto Lending

The crypto lending market bridges those with crypto and those who want to earn money from it. Like traditional loans, investors put their crypto on a platform that connects them with those seeking crypto loans. Borrowers must pay interest on money they borrow, and investors can earn money from their digital investments.

Also Read : How To Choose To Choose A Loand Document Management Software Benefits And Key Features?

6. Digital Identity

The number of fraudulent accounts persists to rise despite banks’ strict KYC and AML checks. The absence of a uniform method for obtaining documentation for those who need to establish their identity increases the risk for the entire system. Surprisingly, about 1.1 billion people worldwide are without evidence of identity, and 45 percent fall within 20% of the world’s poorest.

Blockchain is an excellent solution for providing a secure electronic identity. Clients undergo validation once, granting them a secure identity that can be used to make transactions worldwide. This simplifies the identification process and opens the way to a more accessible and comprehensive system.

Also Read : Reinventing The Financial Landscape Via AI in Banking

7. Regulatory Compliance

Financial regulatory compliance is usually an intricate maze of complicated rules and reporting obligations. Fintech companies are currently implementing blockchain technology to improve compliance with regulations. The need for services regulating the public sector is predicted to rise soon.

Additionally, Blockchain can significantly reduce the time and costs of accounting and auditing services. This results in efficient and cost-effective regulatory compliance within the fintech sector. In addition, Blockchain development services offer an unalterable record of transactions, which ensures conformity to regulations that require an audit trail and data-tracking investment tools.

Also Read : Navigating Expenses Of A Finance App With An Accounting App Development Company in UK

Best Blockchain Use Cases in Fintech

The interplay between fintech and Blockchain offers an array of exciting applications that are changing the world of finance. Here are a few of the most prominent Blockchain uses in fintech

1. Cross-Border Payments

Blockchain facilitates quicker, more cost-effective trans-border transactions. Eliminating intermediaries and currency exchange improves the efficiency of international transfer transactions.

Also Read : Creating An App Like Tamara For User Friendly Split Payment Solution

2. Smart Contracts

Smart contracts automate and enforce agreements without intermediaries. They simplify various financial processes, including processing loan claims, insurance claims, and supply chain finance.

3. Decentralized Finance

DeFi uses Blockchain to provide a decentralized loan, borrowing, or trading platform. It removes the necessity for traditional banks and intermediaries, allowing users more control over their finances.

Also Read : A Guide To Developing A Defi Staking Platform Unleasing Earning Potential

4. Asset Tokenization

Blockchain permits the representation of tangible assets as digital tokens, allowing for the fractional ownership of assets like real estate, artwork, or commodities.

5. Identity Verification

Blockchain provides secure, permanent identity verification. Customers can use financial services without verifying their identity, which increases security and convenience.

Also Read : DLT Applications Change Way With Decentralization Security And Transparency

6. Supply Chain Transparency

Blockchain enhances the transparency of supply chains by recording every transaction. This helps reduce fraud, assures product authenticity, and improves traceability.

7. Real-Time Auditing

Blockchain helps ensure compliance with regulatory requirements through the provision of immutable records as well as real-time auditing capabilities. These are vital in fields like insurance and banking.

8. Micropayments

Blockchain allows micropayments. It will enable users to pay small amounts to purchase content or services without hefty transaction fees.

9. Credit Scoring

Blockchain-based credit scoring considers more data, which could give access to financial services to those who aren’t banked or have limited access.

10. STOs and ICOs

Blockchain lets companies raise funds through the issue of tokens. STOs (security token offerings) and ICOs (initial coin offerings) are becoming popular as alternatives to investing.

Personal Finance and Investment Tools

Blockchain-based apps offer personal finance management and investment tools that allow users to monitor assets across various platforms.

Also Read : Investing in Manufacturing Inventory Management Software Costs And Benefits

Popular Blockchain Fintech Solutions

Here are a few examples of blockchain-related projects that demonstrate their applications within fintech.

1. Chain

It is a significant participant in developing and supporting open-source blockchain protocols designed for financial applications. Chain solution boasts an impressive history of collaborations with prominent financial service giants like Nasdaq, Visa, Citi, Capital One, and Fiserv.

Chain’s product portfolio includes Chain Open Standard, which is Chain Open Standard. It is an open blockchain protocol with a robust production node called Chain Core. Additionally, Chain consists of the innovative Chain Sandbox, a flexible environment for prototyping and thorough testing. It comes with extensive documentation and SDKs—software development kits (SDKs). Based in the tech-driven city of San Francisco, Chain has secured significant investment support from top-quality venture capital firms.

Also Read : Unlocking Financial Prosperity A Comprehensive Guide To Wealth Management App

2. Wirex

The solution is an innovative personal banking solution that seamlessly blends the benefits of blockchain technology with users’ current financial demands. Wirex aims to offer affordable financial services that fill the gap between cryptocurrency and traditional currency. Its main offerings revolve around three benefits: a mobile application, a speedy transfer service, and a swift two-way Bitcoin debit card.

With the Wirex mobile app, customers enjoy the convenience of an all-hours-of-the-day financial platform that allows them to manage transactions anytime. Wirex’s virtual and plastic cards allow quick conversions between Bitcoin and accepted traditional currencies such as USD, GBP, and EUR. The instant remittance service is a secure option for money transfers across borders and eliminates the burden of additional charges.

3. Ethereum

The solution has been hailed as an outstanding blockchain initiative, a step up from Bitcoin, the most talked about blockchain initiative. The Ethereum platform, which Vitalik Buterin developed, began in 2015. Ethereum operates as a publicly-owned blockchain platform specializing in intelligent contract functions. The platform is based on EVM (Ethereum virtual machine). It is a decentralized software developed to execute peer-to-peer contracts using Ethereum.

4. Circle

Circle is renowned for its role as a pioneer in developing USD Coin, a stable coin tied against the US dollar. It provides worldwide payment solutions, allowing businesses to efficiently make and receive payments across borders. Circle has seen a significant increase over the last few years and has joined forces with established firms such as Coinbase and BlackRock to increase its reach and capabilities.

Also Read : Choose From The Top Payment Gateway To Integrate Into Your Robust App

5. CryptoPay

CryptoPay was founded in 2013. It is an internationally recognized fintech firm that provides blockchain-based payment solutions. It allows businesses to seamlessly accept and transfer cryptocurrency payments while integrating with existing payment gateways and online shopping apps.

Users can convert their bitcoins into US dollars, euros, and British Pounds to make purchases or send money to friends. CryptoPay is available in over 80 countries and supports many cryptocurrencies and currencies.

6. We.trade

A digital trade platform based on Blockchain designed to simplify and secure international trade transactions. This results from collaborating with various banks, including HSBC, ING, and Societe Generale. The platform is based on the foundation’s Linux Hyperledger Fabric and operates on the IBM Blockchain Platform.

Also Read : How Has Blockchain Helped A Gaming Platform Become A Game Changer?

7. Paxos

Paxos is a New York-based institution allowing clients to buy and sell cryptocurrencies. It also helps businesses by allowing them to tokenize their assets like real estate and securities using Blockchain. It offers safe and efficient settlement options for transactions in digital assets.

8. BlockFi

BlockFi is a crypto-based financial services company providing credit and interest-earning services for institutions and individuals. Users can make money on interest earned from crypto assets, use their crypto to borrow, and trade different digital assets. It was launched in 2017. BlockFi was a hit with users due to its user-friendly service, low-cost rates, and emphasis on security.

Also Read : Introducing Open Banking API’s The Digital Backbone Of Financial Innovation

Successfully implementing Blockchain in your business depends on your objectives, customers, and the kind of product or service you’re creating. It’s crucial to be aware of the blockchain development process for a well-informed choice.

Blockchain-based real-world projects increase efficiency, transparency, security, and financial accessibility. They are revolutionizing how individuals and organizations use financial services and offer the potential to unlock new opportunities in the ever-changing technological landscape of fintech.

The Future Getting Shaped By Blockchain

Blockchain technology shapes the future of various industries, from finance to beyond. It is an innovative force that ensures safe, transparent, and efficient financial operations and processes, acting as the backbone of the entire fintech industry.

The adoption of blockchain technology and investment are rapidly growing in various sectors. Thus, blockchain technology is set to play a central role in developing the global economy. Here’s a report revealing the rising international investment in blockchain technology.

Because of its decentralization, Blockchain increases trust, reduces operating costs, and protects information security. Fintech’s central position ties Blockchain to technological advancement, modernization, and the prospect of new possibilities for the financial sector and beyond.

In the larger picture, Blockchain can potentially transform industries by promoting transparency, trust, and efficiency. The decentralized ledger system and transparent features are expected to become part of the future of technology. This technology opens an avenue for developing smart contracts, allowing automation and efficiency by removing intermediaries.

Also Read : Virtual Reality Apps Add Value Real Estate Mobile App

In addition, Blockchain encourages an asset’s tokenization, which makes investment more accessible and allows partial ownership over real estate assets. Furthermore, it is driving the growth of decentralized finance, which provides lending, banking, and trading services not offered by traditional bank intermediaries, thus increasing access to financial services.

Blockchain’s influence extends into supply chain management, providing traceability of products and ethical sourcing. It also affects those who deal in NFT (non-fungible currency), which creates new possibilities for owning digital assets in music, art, and even virtual real property. The increasing importance placed on interoperability among different blockchain networks facilitates collaboration and creativity at a global level.

However, environmental issues are included, especially with the push to develop sustainable blockchain solutions that are eco-friendly and environmentally sustainable mechanisms for consensus. This is crucial in guaranteeing the viability of blockchain technology.

Also Read : The Ultimate Guide To NFT What It’s And How It Works

Conclusion

Ultimately, fintech transformation is altering the world of financial services, driving innovation, and changing how individuals and companies manage their finances. From digital payment and blockchain technology to robo-advisors, alternative lending, and robo-advisors, Fintech innovations are revolutionizing accessibility to banking services, encouraging financial inclusion and economic empowerment.

As the fintech sector grows, stakeholders must navigate regulatory hurdles, address cybersecurity issues, and take advantage of technological advances to seize the opportunities created by this transforming business.

Also Read : Cybersecurity Assest Management An Efficient Manner To Legitimize Your Security Team

If you are willing to upgrade your business by incorporating Blockchain technology, Techugo is a leading company to be the right partner. With our expertise in developing cutting-edge mobile apps and their deep understanding of the fintech industry, we can help bring your fintech ideas to life. Our commitment to quality, innovation, and security makes them a reliable choice for creating fintech solutions that are user-friendly and technologically advanced. Get in touch with Techugo and say “hello” to innovation and security.

Post Views: 1,694

SA

SA

KW

KW

IE

IE AU

AU UAE

UAE UK

UK USA

USA

CA

CA DE

DE

QA

QA ZA

ZA

BH

BH NL

NL

MU

MU FR

FR