In a time when collaboration using money is essential, creating a split-payment app like Tamara is an exciting venture. This guide will walk you through the vital steps from ideation to launch to show how complex the development process, marketing positioning, and user experience could be.

Since online purchases are constantly evolving, a split-payment application is necessary for families, friends, and colleagues to manage sharing costs effectively. The purpose of this guide is to provide the steps you must follow to make your dream work. This blog provides all the information anyone needs, from experienced engineers to entrepreneurs entering the IT industry for the first time.

We will go over every detail to create an app that is highly secure, feature-rich with an easy-to-use design, from planning and market research to choosing the most reliable technology platform. You can start with us and, in the end, develop a split-payment application.

What is Tamara?

Before examining the intricacies of constructing an application for split payments such as Tamara, it is essential to understand what Tamara is and why it’s gaining popularity in the field of financial technology. Tamara is a fintech platform that provides buy now, pay later (BNPL) services to customers and online retailers. BNPL solutions have grown more popular in recent years because they allow consumers to purchase products and pay for them in installments at low or no interest rates. Tamara allows customers to divide the online purchase into interest-free installments, usually over three to four months.

Below are a few essential statistics regarding the state of cashless payment apps across the US:

Size of the Market and its Growth

- Mobile cashless transactions are predicted to reach $1.7 trillion by 2021 and grow steadily over the next few years.

- The total value of transactions is expected to grow by an annual growth rate (CAGR 2023-27) of 14.66 percent, translating into the projected total value of US$3,528.00bn in 2027.

User adoption

- 53 percent of Americans utilize digital wallets more frequently than traditional payment methods.

- For digital wallet customers, 69% use PayPal the most. Next are Google Pay (56%), Apple Pay (53%), and Samsung Pay (52%).

- By 2021, more than 400 million users with active PayPal accounts had been assessed, an impressive rise from previous years.

Specific App Usage

- Apple Pay has the most active app users, with 43.9 million users having used it last time.

- Venonce with Cash App is famous for P2P transactions, with 52% and 49% of users using it.

Also Read : What is the Cost of Building a Fintech App?

Features and Functions of The Top Online Payment App Like Tamara

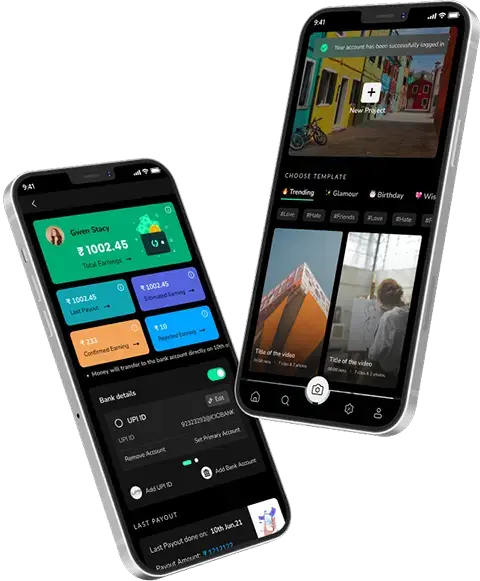

With split payments, shop and pay now or in the future, Tamara attracts many iPhone and Android users. Its user-friendly functions and easy and appealing User Interfaces (UIs) are another reason for its rapid growth in the digital market. If you’re planning a Fintech app design, the session will help since we’ve highlighted a few key aspects of Tamara, an online payment app. These features play a crucial factor in its popularity across MENA (the Middle East and North Africa) countries.

Here we go!

1. Easy Registration and Login

Tamara is available for download through the Google Play and App Store. Once the user has downloaded Tamara, the application’s installation or bounce rates depend on the accessibility you offer the people you want to reach. Users can sign up with just two or one credential and access your application quickly. This will improve app acceptance and increase the number of users who install your app.

Tamara, the most popular payment app in UAE, offers quick app accessibility by verifying users’ identities using their mobile numbers and ID information. The app guarantees immediate approval in just minutes to access its functions. Therefore, if you’re seeking to develop an app like Tamara, ensure that you make simple and appealing user registration and login modules.

2. Easy-to-Use Landing Page

It is at the foundation of all web and mobile applications. It is that users go to access internal service pages and search for the services they want online. Tamara is one of the most popular Fintech mobile apps available in the UAE. The app was created and designed with an easy-to-read landing page. Customers can shop by brand and discover deals on brands or products, as well as make their online shopping easy.

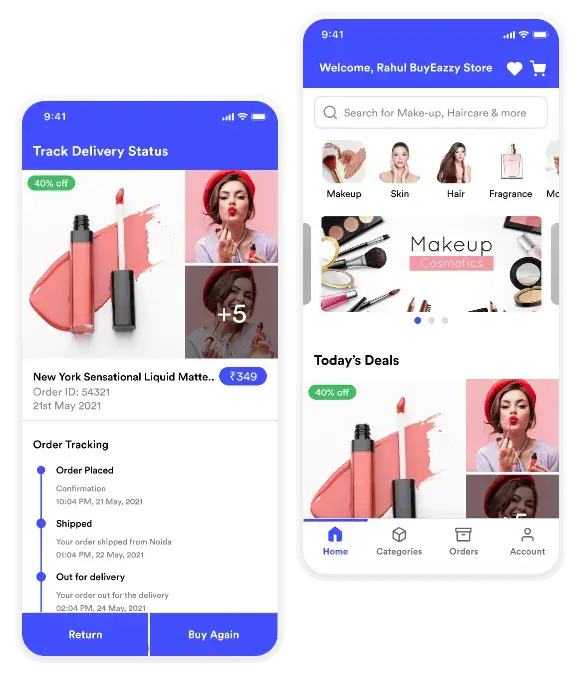

3. Let Users Shop At Their Favorite Brands

Tamara’s best-in-class payment application allows its users to shop their preferred brands, such as Shein, Faces, YSL, Floward, IZIL, Nice, Namshi, and numerous others, and enhance their shopping experiences. Thus, the Tamara application lets users shop from over 1,000 well-known retailers and brands.

4. Discover Deals and Get Discounts

This is another excellent characteristic of the UAE’s Tamara, most-used online payment app. Users can enjoy special deals and discounts on top brands. To expand the number of users, the fintech companies also offer attractive discounts for users who refer apps to other users.

5. Next-level Payment Options

This feature makes Tamara an exceptional payment option for residents across the Middle East. Interest-free payment in three installments with no paperwork is the best digital experience on your app and eliminates the stress of large bills in one payment. Users can divide their payments into three installments or pay them off later within 30 days.

6. Push Notifications

It’s among the most valuable features of online business applications. Featured brands or merchants can send push notifications about deals, discounts, and payments. Users don’t have to keep track of their purchases frequently. The application will keep updating with the most recent events and will send status updates to users.

Tamara, the top online shopping platform available for Android and iOS, allows users to be on top of their EMI payments and does not permit them to incur any additional amount for bounce fees. This is among Tamara’s most distinctive and user-centric features, and it is a top FinTech app like Tamara in Saudi Arabia.

7. Benefits of Payment Applications

Payment apps are now integral to our lives, changing how we manage money. There is no need for large wallets and struggling to find cash. These convenient digital devices offer many advantages, making finances much easier, faster, and more secure. Here’s a look at some of the main benefits of making use of payment apps:

8. Unmatched Convenience

Take the stress out of carrying cash or remembering many credit cards. Payment apps such as Google Pay, Apple Pay, and Samsung Pay let you securely store all of your payment information on your mobile. One tapping or scanning is all you need to pay at the checkout, whether at a store, restaurant, grocery store or to make an online purchase. Don’t waste time digging through your wallet or searching for the right card. Just a simple tap, and you’re ready to go!

9. Speed and Efficiency

There is no need to worry about having to wait in long lines or battling slow transaction processing. Payment apps can process transactions at lightning speed, making payments quick and easy. Whether you’re splitting bills with a group of friends or paying for groceries, it’s quick and effortless, allowing you to save precious time and effort.

10. Enhanced Security

Are you worried about carrying cash around and having your purse stolen? Payment apps have robust security features, such as encryption and multi-factor authentication, making them more secure than traditional payment methods. Your financial data is stored securely in the app, and many platforms provide transaction alerts and dispute resolution options for more security.

11. Rewards and Perks

Pay-to-go apps aren’t just for convenience; they can provide a great reward! Many platforms offer cashback programs, loyalty points, and discounts that turn daily interactions into opportunities for rewards. If you’re a regular coffee drinker or a devoted online shopping addict, a payment application will assist you in accumulating savings and gaining benefits.

12. Budget Tracking and Insights

Thanks to payment apps, controlling your finances is now easier than ever. Many platforms provide comprehensive budgeting tools and tracking of your spending, which allows you to classify your expenses, establish spending limits, and monitor your progress toward the financial targets you have set. With real-time information about your money habits, it is possible to make better decisions and manage your finances more efficiently.

These are only a few of the many benefits payment apps can provide. From speed and convenience to security, rewards, and financial insight, they have revolutionized how we manage our finances and make our lives simpler and more efficient. They also make us financially smarter. Why not get rid of your bulky wallet and use payment apps? You may be surprised at how much more straightforward and enjoyable managing your finances could be!

Also Read : Why Fintech Payment Apps are the Future of Secure Transactions

How do you Build a Split Payments App like Tamara?

During development, ensure that the security techniques that protect users and financial data get the attention they deserve. Also, ensure that the channels of communication are open to users so that you can gather feedback and continue to improve the app according to their needs and desires. Below are some steps to consider when creating a split payment app like Tamara.

1. Market Research and Planning

Conduct various market research to learn about your competition, the audience, and market trends. Make a list of capabilities and features that will help your application stand out. Create a comprehensive business plan that outlines your goals, the target market, marketing strategies, and profit strategies.

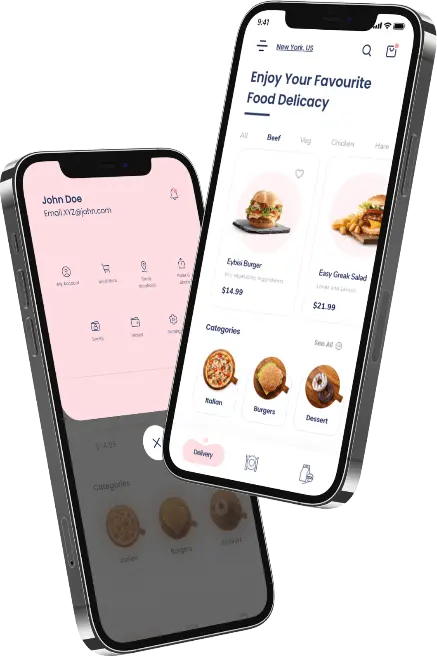

2. Wireframing and Design

Create wireframing that shows how the app’s structure works, how user experience is handled, and how navigation functions. Engage mobile app development company in UAE to develop mobile apps. They will create something that looks excellent, works well, and aligns with the brand’s style. Incorporate the user experience rules to guarantee that the split app is simple for people to use and navigate.

3. Development

The development process begins when you have the wireframes and style. Engage a mobile app development company in UAE to select a technology stack and style that will work well with your application. The essential features, such as real-time tracking, sharing of payments, and security protocols, must be put into place.

To add additional features, make sure that the application for splitting payments is compatible with third-party payment platforms and APIs.

4. Testing and Quality Assurance

Test the program thoroughly to identify and correct any security holes, bugs, or other issues. Verify that the software meets a high standard of quality by testing its performance, security, and user-friendliness. Learn during beta testing to enhance the user experience and address any issues.

5. Deployment

After the testing and quality assurance are completed, you need to prepare for publication. Place the app in the appropriate app stores, like the Apple Store and Google Play Store. Make sure that the rules and regulations for the store’s app are observed. Design a marketing strategy to promote the app’s debut.

6. Maintenance

After the app launch, check its performance and review it by users. Utilize updates and changes to correct issues and enhance features according to what users have to say. The app should be adapted to the changing business environment and technology in order to guarantee effectiveness. It is possible to add new features or functions to keep up customer engagement.

Also Read : How To Develop An App Like GCash To Build A Cashless Ecosystem?

What is the Payment App Function?

Payment apps function as sophisticated financial machines that work in the background to smoothly finish your transactions. This is a brief overview of the procedure:

1. Connecting your Accounts

Connecting your credit card or debit card and bank account with the app for payment is possible. This is done by securely transferring your financial details to the app’s designated platform.

2. Initiating a Transaction

If you wish to pay someone else, select your recipient (for P2P transfer) or the merchant (for purchase). Enter the amount, and then confirm the transaction.

3. Transfer and Encryption of Data

The app encodes your transaction data and transmits your information to a secure payments network. The network is an intermediary between your bank and the buyer’s bank.

4. Authorization and Verification

The network validates your details and approves the transaction based on current funds and all security checks (such as the use of PINs or passwords).

5. Transfer of Funds

Once authorized, the network will transfer the funds from your linked account to the recipient’s or merchant’s bank account upon confirmation. You will receive a message within the application about the successful completion of the transaction.

6. Additional Elements

- Contactless payments: Near-field communication (NFC) technology allows your smartphone to connect with payment terminals and facilitate instant transfers without physically tapping your card.

- In-app purchase: This app is an intermediary that processes payments between your connected accounts and merchant platforms.

- Measures to Protect Yourself: Payment applications employ multiple layers of security, including data encryption, fraud detection algorithms, and multi-factor authentication, to ensure the security of your financial information.

Cost Estimation To Build Mobile App Like Tamara

The price of mobile app development depends on various variables, such as location, platform, team, technology stack, etc. However, we can provide an approximate figure. Let’s break this number down into the significant phases of development.

Generally, one can anticipate spending between $50 and $30,000 to create a basic Buy Now, Pay Later (BNPL) app like Tamara. This will comprise basic features like user registration, product browsing, checkout, and payment processing.

For a more complicated application with additional features, for example:

- User-friendly Interface

- Integration with a variety of merchants

- Security features with advanced capabilities

- Real-time analytics

If you are required to develop an app that works on Android and iOS, expect to spend between $50,000 and $300,000. You can anticipate shelling out an additional 20-30 percent of the total cost of developing a mobile app. Below is an overview of estimates of the mobile app development costs for each element in the process of development:

- Gathering and planning requirements: $1600 to $3,200

- UI/UX design: $2,400 – $4,800

- Backend development: $3,200 – $9,600

- Frontend development: $3,200 – $9,600

- Deployment and testing: $1,600 to $3,200

- Integrating third-party services: $800 to $8000 (depending on the quantity and degree of complexity of the integrations)

It is crucial to remember that these estimates are only estimates. The actual cost of developing mobile apps will depend on your specific needs. It is recommended that you obtain quotes from several fintech app development company before making a final decision.

Also Read : Grab on the Power of On-Demand Delivery With Your App Like Mrsool!

Factors Affecting Mobile App Development

The following variables could affect your cost to develop a mobile app in Saudi Arabia like Tamara:

1. Complex Features

The more complicated your app’s features, the greater the cost of developing it will likely be. Features include customer profiles, product catalogs, payment, processing, and fraud detection, and incorporating new technologies like AI, ML, Blockchain, and more.

2. Development Platform

The choice of developing your application on Android, iOS, or both platforms can impact the mobile app’s cost. The development process for multiple platforms is usually more expensive than developing for one platform. It’s up to you to select your users and develop your app to meet their needs.

3. Development Team Location

The location of your development team could influence the cost to develop an app in Dubai. Teams from developed countries like the US and Western Europe typically charge higher costs than teams operating in developing nations. To reduce costs, look for a mobile app development company in Saudi Arabia that develops mobile apps, such as Techugo.

4. Integrations from Third-Party Providers

This could increase its development costs if your mobile app requires integration with third-party applications, such as payment processors, social media networks, or even governments.

5. Design and Customization

The more personalized and unique the look of your app, the greater the price will be. Thus, design and customization has its own importance as much as price.

6. Project Management

Requiring an internal project manager to manage the development process could add to the mobile app development costs. The advantage of outsourcing your project to an on-demand app development company is that they will provide an individual project manager who will handle the entire project from start to finish and keep you well-informed of every stage.

7. Testing

It is vital to conduct thorough tests to ensure that your app is error-free and performs exactly as you intended. It can be a lengthy and costly process. If you decide to outsource your work, you will only need to handle a handful of team members, and they’ll handle the remainder. They have fully managed teams that include designers, engineers, and testers.

8. Maintenance and Deployment

Once you have developed your app, you need to launch it in the app stores and then maintain it over time. At Techugo, we offer the most precise estimates of our services, which include every aspect of maintenance, both post- and pre-maintenance and deployment steps.

How Can You Generate Revenues From FinTech Apps like Tamara?

Pay-as-you-go apps for Buy Now development are on the rise worldwide. Top mobile app development company in UAE, USA, and India collaborate to produce excellent results in the FinTech sector.

Tamara app is a prime example of a FinTech company promoting the next generation of technology. Instead of requesting money from customers and placing financial pressure on consumers, local and online retailers are working with Fintech companies like Tamara to boost sales conversion rates and build brand trust.

Tamara pays for customers’ purchases and collects the money in a time-bound period. This is similar to using a credit card to pay our bills later. Here are some of the most effective strategies for monetizing apps you can use when using Tamara’s Buy Now and Pay Later FinTech application.

1. Earn Commissions From Brands

If you create an app like Tamara, you can collect payments from brands interested in partnering together.

2. Commissions On Orders

This is why the Tamara application is generating massive revenue flows. While Tamara is an online payment solution, it’s widely regarded as the top shopping application in the UAE. International and domestic brands have joined forces with Tamara to sell their goods through an online platform.

If so, developing an app like Tamara can benefit businesses by generating additional commissions per purchase. This means that you can collect commissions from brands listed on every successful purchase.

3. Earn For Featuring Brand Names On Top List

It’s the most effective method of monetizing apps. The products or brands featured in the app attract users’ attention and are more likely to result in sales conversions. This is the main factor that Tamara is akin to. Ecommerce app development company may charge brands additional fees to include them on their pages and gain a competitive advantage over competitors.

4. Collect Bounce Charges From Customers

In general, Tamara, the top online payment app available for Android and iOS, doesn’t charge customers any fees. However, since it’s a Fintech application, you can collect EMI bounce fees from your customers.

The app like Tamara can prevent users from skipping their EMI payments by notifying them of their due dates. However, if the customer has not paid their bill by the due date, you cannot collect additional forfeit charges. Tamara’s application charges 25 SAR/25AED/2KWD as late fees for Saudi Arabia, UAE, and Kuwait customers. They are among the most efficient Fintech application monetization strategies for earning extra cash from web payment cum shopping apps.

Conclusion

The process of developing split payments apps like Tamara evolves from the current financial dynamic. This guide will help you navigate the intricacies of development, with a focus on the importance of market research, a customer-centric method, and strong tech stacks.

As you navigate through the landscape, it is crucial to consider the possibility of an app like Tamara to recognize the transformational effect of an app that incorporates collaboration in financial communication. The journey doesn’t stop at the stage of development because it continues to be continuous enhancement, integration of user feedback, and ensuring that the application is in tune with market trends. Be open to the changing digital environment in which financial technology changes how groups and individuals manage their expenditures. When you take on this project, you are contributing to the smooth, efficient, transparent, and effective future of financial accountability shared by all.

If your goal is innovation, entrepreneurship, or filling gaps in the market, this guide will allow you to create an alternative split payment model like Tamara that is in line with and even exceeds.

Don’t think anymore! Get in touch with Techugo to develop an app like Tamara now!

Post Views: 4,101

SA

SA

KW

KW

IE

IE AU

AU UAE

UAE UK

UK USA

USA

CA

CA DE

DE

QA

QA ZA

ZA

BH

BH NL

NL

MU

MU FR

FR