Online trading has gained so much popularity in the last few years. People want to take charge of their investment strategy and the instruments they invest in. That’s why mobile investment apps are increasingly attractive to new investors who appreciate being able to keep an eye on their portfolios on the go. Many entrepreneurs seek investment app development as they have transformed how individuals handle finances, offering users access to manage finances anytime they choose, wherever they may be located.

Investment apps have quickly become highly effective financial tools, allowing people to control finances whenever and wherever they please. They are becoming widely popular due to providing people access to 24/7 financial management capabilities anywhere they choose. According to a report, the market for digital investments will reach US$5.27 trillion by 2027, making this sector highly competitive yet potentially profitable. If you want to remain relevant in today’s marketplace, monitoring investment apps’ popularity closely may prove key to succeeding competitively in any given situation.

Today’s blog post will examine key steps you must take when considering an investment app development to maximize its full power and make your solution economically feasible. We will explore various app types and options before providing insight into what needs to be considered when developing such an investment application. Also, we’ll find a mobile app development company in UAE that can give the right attention to your investment project.

Also Read : FinTech in Investment Banking: How It Can Help the Unbanked Population?

Let us get started!

Understanding Investment App Development

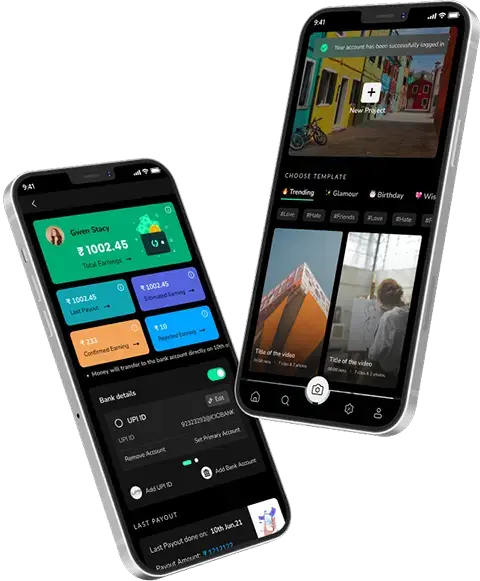

Accessing your investment portfolio anywhere and even on the move using your smartphone is very appealing. This is precisely the purpose of investment apps. An investment application is a mobile service that allows users to manage and invest their funds in various financial markets, including bonds, stocks, mutual funds, and crypto. New and experienced investors can use the investment app to monitor their stock market investments and investments across other financial markets.

Investment apps can aid investors in saving money and increasing their investment through a wide range of adaptable options at low fees for apps. For instance, online investing applications provide users with numerous tools to keep track of portfolios in real-time, make informed choices about their transactions, access education and research tools, and many more. They can be essential platforms for buying ETFs and stocks or more sophisticated applications that offer sophisticated instruments to professionals trading.

Types Of Investment Applications

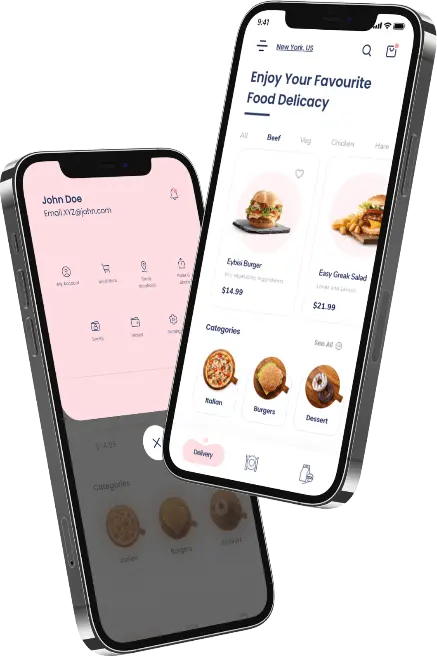

The primary purpose of investing apps is to help people control their money. Although all of these apps function similarly, they can be categorized according to the level of assistance they provide their users.

1. Banking Applications

Banking and “do it yourself” apps offer users little or no assistance. The app provides the most basic details about stocks, such as their prices and the amount required for purchases, but not built-in analytical tools or recommendations for investment strategies. The primary benefit of such apps is that they integrate various financial functions in one location. So, app users can track their daily expenses, income, and online investments using a single app.

2. Robo-Advisors

This type of application is enhanced with artificial intelligence (AI) that analyses market trends using historical information. After a quick examination of the user’s behavior and personal preferences, robo-advisors can provide options for improving your investment strategy and getting additional value from trading.

3. Exchange Platforms

Some people use exchange platforms for investment purposes. In this case, they want to diversify portfolios by using a broad selection of tradable assets like bonds, stocks, and crypto. Suppose you plan to develop an exchange platform with investment features. In that case, we recommend including analytical tools for market research for portfolio and risk management.

4. Hybrid

They combine the advantages of two kinds. The user can rely on the latest technology or make decisions regarding the kinds of investments. Making an investment application like it is an excellent alternative because it can meet most customers’ online investment requirements. However, remember that an application featuring a wide range of features takes more time and resources to develop.

Also Read : Multi Cloud vs Hybrid Cloud: Selecting the Appropriate Cloud Architecture for Your Business

5. Human Advisor Apps

They are among the highest-end kinds. The analytics are all conducted by people with the relevant knowledge and education to assist customers with making informed choices about their investments. This is an excellent feature of an app for investing.

Why Should You Develop An Investment Application?

The investment application provides live information regarding publicly traded companies. This app lets you remain informed about the stock market and other investments in the financial industry. A keen eye on the market for investment helps you benefit from the readily accessible data at your fingertips for minimal application costs. Below are some advantages to establishing an investment-related app.

- The hugely popular digital investment market is the main reason for creating an investment app. Many investors experiment with trading stocks, portfolio management, and saving methods.

- The investment application makes investing easily accessible to an even wider audience without the requirement to join traditional brokerage firms.

- The third argument for an investment app development is the wide range of niches you could choose from. For example, it is possible to create an app for beginners to begin their journey, add retirement plan choices, and even begin selling gift cards to purchase cryptocurrency.

- Another aspect that needs to be considered is the expense that newbie investors will pay for a portfolio comprising fund diversification. Banks, mutual funds, and investment trusts have hefty service costs, making it difficult for ordinary people to pay. Similar services are available online but at a lower expense. Opportunities are more significant for those willing to pay higher costs, such as handling margin accounts, working long hours, and reaching financial targets.

Also Read : How much does it Cost to Develop an App like DIB (Dubai Islamic Banking)?

Must-Have Investment App Features

The investment application must include various elements. These can perform essential functions or offer a distinct customer experience, distinguishing your investing platform online from the market.

1. Onboarding And Registration

One of the first things you’d like the users of your app to do is sign up. In this case, you could invite registration using an email address, telephone number, email address, social media sites, or an account. The more options you can offer them, the more convenient and quicker the process will be for them to begin using the app.

To prevent login and security problems, it is recommended to utilize biometric authentication such as fingerprints, face IDs, and so on. Furthermore, it’s worthwhile to include two-factor authentication to provide greater security and better data security.

Another crucial aspect to remember during registration is the onboarding process. By providing an extensive overview of your application and its features and capabilities, users are aware of the advantages it provides. In addition, it assists users with navigating the app better and provides an enhanced user experience.

2. Trading Management

Trading management features are crucial to the app. Without them, users won’t be able to complete trades in the first place. Therefore, make sure you implement powerful tools to enable investors to purchase and sell orders, keep track of stocks, and, in general, manage their financials. The app should also assist in tracking transaction history and reviewing account balances.

Also Read : How to choose a Loan Document Management Software? Benefits and Key features

To improve trading and trade management in your investment application, consider integrating the application with payment methods to facilitate easy cashless transactions. When implemented correctly, this can be a great way to boost user loyalty to your product.

3. Personal Profile

Your profile is the most critical element for managing personal information. It will enable users to complete details such as names, ages, trade experiences, financial goals, etc. The app can use these insights to determine the investor’s preferences and provide appropriate alternatives and advice that align with the user’s goals.

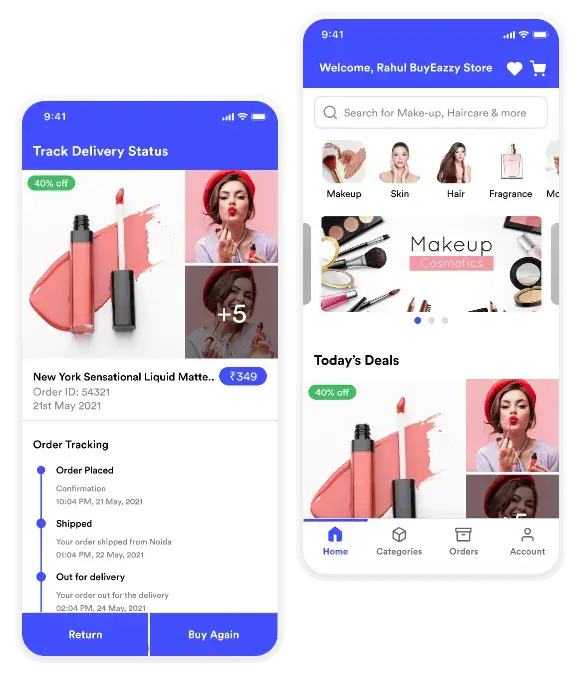

4. Market Analytics

Market analytics is a crucial attribute that benefits investors. It gives investors useful information and tools to make sound financial choices. Customers can access live market information as well as charts. They can evaluate the performance of indicators, track markets, look at trends, outline risk areas, and more. Additionally, market analytics provides information about portfolios and individual recommendations based on market trends and the customer’s goals.

5. Funds Withdrawal

The feature lets users withdraw money from the app whenever they want to access their funds. The app gives investors freedom and control of the investments they make. When they withdraw funds, traders can convert their investments to cash anytime. It allows them to alter their portfolios of investments, reallocate funds, and cash out profits with no time or restriction.

Also Read : Online Banking Management System – Its Scope and the Technology Used

6. News And Social Feeds

They can significantly boost user engagement with your application. When you integrate market news into the app, you can provide the most current and accurate information on the market. On the other hand, social feeds include comments, allowing traders to talk about common issues. These features help build community and improve the general investing experience.

7. Performance Analytics

Offer detailed analytics on performance with graphs, charts, and interactive images for users to analyze the investment’s performance in the long run. This concept is akin to the live data. The more data you can provide, the more you can provide. Knowing how one’s performance has been is essential in determining a long-term investment plan. With no proper data, individuals may be misinformed about their investments and believe that only certain investments will yield profits.

8. Account Sync And Integration

Many investment software don’t give the options needed to run an excellent portfolio. Therefore, the ability of investors to connect their accounts with various financial institutions and integrate all their investment resources into the same place is logical. The integration with other platforms or brokers eases the handling of several accounts. Retail investment applications that are the best permit investors to make the most of their investments by utilizing various sources.

9. Electronic Wallet

It is where the money to invest in the future is stored. Two main requirements are safety and easy accessibility by a qualified person to supervise the assets stored there. The most reliable investment application online will be able to link to both credit and bank card networks to get timely updates and ensure the security of users’ financial information via telephone.

10. Investment Research Tools

Fintech app development company integrates comprehensive tools to research, including corporate profiles and reports on financials, analyst ratings, and stock screeners that will assist your customers in conducting extensive research on investments. The more details you can provide, the better decisions a typical consumer can make. Information is the power of modern marketplaces. Users will appreciate your power of information to increase their influence by studying the most crucial information.

11. Financial Knowledge And Consulting

A program that lets users sell and buy is less valuable than one that offers the user information about the investment. It would help if you thought about providing financial literacy training for beginners through engaging videos or articles and an AI-powered adviser that assists you in making the most appropriate decisions by swiftly providing helpful information. An AI investing app can offer you an advantage over your competitors.

12. Customer Support

You should consider providing customer service that will enhance users’ comfort and satisfaction with your product. For example, you could consider introducing live chats, a callback option, and direct communications with support staff. This will allow investors to make the correct decisions when they have questions or concerns.

Also Read : Mobile Banking Trends in the UK : The Rise of Fintech

Steps To Develop a Mobile Investment App

As users’ expectations increase and demand, a robust financial application is now an essential feature. The app’s user-friendly, functional, and easy-to-use features require a well-organized method to be in the game, relevant, or better than the competition ahead.

Below are the steps you should follow for investment app development:

1. Create Objectives And Do a Market Study

To develop your investment services, examine your rivals. Learn about their business models and features. Be aware of any errors and inconveniences that can be avoided in your investment program.

2. Pick a Monetization Method

If you decide on a monetization plan for your investment platform, ensure that it aligns with your company’s strategy, target market, and the app’s benefits. You can make money through ads in the app, premium subscriptions, transaction charges, or any combination of different methods.

Make sure to strike a balance between your levels of profit and your users’ satisfaction. This will ensure that potential customers don’t feel disappointed when they see an overwhelming amount of fees and advertisements in the application.

3. Find a Mobile App Development Company In UAE

To select the right company to create an investment application, it is recommended that you begin by looking through the list of portfolio companies. An already-experienced mobile app development company in UAE must be able to create numerous mobile applications to help investors, both on iOS and Android. Be aware of the clients’ testimonials. Reviews will assist you in determining your expectations for the app development service.

Also Read : What is the cost to build a mobile app in the UAE?

4. Create a List Of The Features You Want To Include

The first step is determining if you want to create an MVP or a mobile app with expanded features. MVP (minimum acceptable product) is an operational version of your application with simple features. Its MVP creation lets you test your app before launching and prevent unnecessary spending. You can start creating a sophisticated investment application if you’ve tested the concept.

An MVP model typically has user registration and authentication with essential trading functions, portfolio tracking, and solid security elements. When you create an investment app featuring advanced features that include education tools, virtual advisors, social components, and detailed analytics that allow users to make informed decisions about investments. There’s nothing wrong with that if you don’t know exactly what features your app needs to contain. You can ask the agency for assistance and discuss ideas with them.

5. Develop UI/UX Design

This is when your idea begins to come into existence. Designers from a professional company work on the app’s interactive and visual components to ensure that it will become more appealing to the people you want to appeal to. When creating an investment application, be sure it’s not only pleasing to view but extraordinarily user-friendly and functional:

- Build a user-friendly, clear navigation system that includes menus and icons so users can effortlessly access the various parts of the application.

- Check that your application is compatible with a variety of screens and sizes. Make use of fonts that are simple to read. Maintain an identical typography across the application.

- Pick a color palette that matches the area and matches the brand.

- Review the examples of design for financial apps to understand better the most common features users look for in your app.

6. Develop An MVP

It’s time to relax in the back and participate in the process. The team developing your app will assist you with vital information like the technical stack, APIs, and the integrations you require. Proficient developers are aware that an MVP is required to adhere to specific regulations regarding safety and conformity. The first step is to make sure that the user account is secure.

The app must be secure in handling personal information according to the GDPR (General Data Protection Regulation) and other data protection rules for any country where the investment app operates. It must also provide security for banks to refill your investment account or withdraw money.

7. Launch Your Application

It’s a point at which all the necessary preparations have been made, and your application is now ready to be used by clients. Be sure to supply promotional material (screenshots or videos) to promote the application. The agency is in charge of all technical aspects of the launch, and you must be attentive to the initial user feedback.

8. Keep Your App Up-To-Date

It’s a continual stage of improving the quality of your app. It is essential to update the app’s function and layout based on user comments. It is necessary to upgrade your app to keep it secure regarding applications for financial transactions. Make sure you regularly conduct security audits and penetration testing to discover weaknesses within your application and ensure that users’ data is secure.

Develop a comprehensive plan for responding to incidents and what to do in the event of a security breach. The plan should contain strategies for communication, measures to contain the threat, and recovery steps.

Also Read : What is the Cost of Building a Fintech App?

How Much Does It Cost To Build An Investment App?

An investment app development can cost anywhere between $70,000 and $120,000. It could be higher depending on the functions and features you want to incorporate. When determining your budget for the app, consider all factors that can impact the costs, including the level of complexity of applications and the features they offer. Start with the basics, then upgrade to more advanced features over time.

The cost to develop a mobile app in Dubai can vary based on a variety of factors. In-house development teams are more expensive than outsourcing the entire project. Development costs also depend upon the area where the developer will be hired. Outsourcing, in general, is a preferred option since they are charged hourly, which is reasonable. Various factors can influence the price, like the level of complexity of applications and the features they offer. It is possible to start using the fundamental features, and in time, you can upgrade to more advanced features.

Project Management Approach For Investment App Development

There are numerous agile mobile app development methods, from scrum, lean, and even extreme programming. Choosing the best option and method takes work. However, within the larger framework of agile technology, scrum is well-known as an iterative app development method. The primary stakeholders in the backlog of projects and agile software development using Scrum. The project manager is the scrum master. A product owner (PO) in a form known as the “Product backlog” provides the requirements or specifications.

The scrum team estimates the sprints, attributes, and other aspects planned through the ScrumMaster. The development team creates a prototype product and then works on it through more sprints. The scrum group has a stand-up session called ‘Regular’ during project execution. This meeting aims to determine the project’s status, and the scrum master utilizes it to resolve disputes.

To get a complete analysis of your specific iOS or Android app development strategy, you can contact a company specializing in software development and ask them for suggestions.

Also Read : Stock Trading App Development: Eliminate Middleman & Invest Wisely!

How To Monetize The Investment App?

The ultimate goal of creating an application is to make it financially viable. This is why it’s crucial to consider monetization strategies when planning the application. There are numerous ways of making money with an application. We will discuss a few standard methods.

1. App Purchases

Provide premium features and extra tools for users to purchase in the application. It can include the latest analytics, customized investment advice, and access to exclusive information. A module-based system can benefit investors by allowing those using the investing app to pick only the required functions.

2. Subscription Model

Create a subscription-based pricing system that allows users to pay monthly to use top-quality features or get enhanced services. Different subscription levels have various advantages. People who are constantly working could find investing within the top tier beneficial. Others may prefer simple alternatives.

3. Commissions And Fees

If your app permits users to trade in securities and other securities, you could earn income through transaction charges or commissions on every trade that is executed by the application. Many financial institutions base large portions of their income on transaction fees of all varieties.

4. Advertisements

Include targeted ads within your app to incorporate targeted ads. Advertisers can pay to show their services or products to users of your app. Then, you’ll profit according to the number of clicks or impressions. This method works perfectly alongside other kinds of monetization. Users could offer money in exchange for access to premium services that remove ads.

5. Partnerships And Referrals

Work with financial institutions and brokers to receive referral commissions or fees by directing customers to their products and services. This could involve referring clients to create brokerage accounts or investing in specific funds.

Also Read : Unleashing the Power of AI: Transforming Software Development with Machine Learning

Tips To Create An Investment App

Are you looking for tips on making an investment plan? Here are a few essential suggestions we could offer to our customers:

1. Identify Your Target Audience

Know the particular requirements and preferences of the users you want to target, whether they’re new investors, traders, experienced, or a particular population segment. Customize the app’s functions and features in line with their needs. There’s a demand for simple investing applications and sophisticated options. It is important to research the many possibilities.

2. Streamline User Experience

Develop a simple and easy-to-use user interface to simplify complex investment decisions. Ensure you have straightforward navigation, simple terminology, and well-organized data to improve user satisfaction. Complex interfaces that make simple functions confusing to users are the most likely approach to sabotage the application’s promotion. The principle is the same for every app type: the simpler, the more straightforward.

3. Ensure Data Security

Most investment apps contain susceptible data about the individuals who use them. How do you create an investment app that will satisfy unlimited users? Priority one in protecting users and their transactions should always employ stringent cybersecurity measures that safeguard users’ private data and transactions. Use encryption protocols, secure authentication techniques, and regular security audits to ensure trust and reliability. Security is essential for maintaining your image in today’s investment market.

4. Integrate Real-Time Market Data

One of the significant features of modern-day investment is the constant change in the primary markets. Suppose you’re not able to provide accurate information. In that case, clients cannot make high-quality choices regarding their investment portfolios. What do you need to do? We recommend incorporating trustworthy APIs to supply users with market information such as news, stock prices, and financial data. Up-to-date and precise information aids in user decisions and increases overall user experience.

5. Provide Customization And Individualization

A common thread throughout the modern world is that everyone is unique in understanding notions like convenience and ease of use. This is why the mobile app development company in Saudi Arabia needs to allow users to tailor their portfolios, investment choices, and alerts. The ability to customize features lets users adapt the application to their particular investment needs and methods, creating a feeling of ownership and involvement. A mobile app modified to meet users’ specific requirements is more likely to perform well in today’s market.

Conclusion

Creating an investment application may appear easy, but it’s a bit challenging. Consider every element, technology stack, and functionality to ensure your app is always on top of trends. Suppose you want to ensure that your app is effective and keeps up with your expected return on investment. In that case, it is recommended that you hire an investment company for app development with the abilities and experience to finish the project.

If you follow the guidelines in this article, such as conducting thorough market research, creating a user-friendly interface, adding solid security measures, and implementing a successful method of monetizing, you could build an investment platform that will be a hit on the market. A properly designed and well-featured investment app will likely transform the way investors approach investing and interact with it.

Techugo, a leading mobile app development company in Dubai, offers a comprehensive suite of services to help you build a successful investment app. With our expertise in financial technology and a proven track record of delivering innovative solutions, we can guide you through every stage of the development process. From conceptualization and design to development, testing, and deployment, our team of skilled professionals will work closely with you to create an app that meets your specific needs and exceeds your expectations.

By partnering with Techugo, you can leverage our in-depth knowledge of the investment industry to develop an app that resonates with your target audience. We understand the importance of security, reliability, and user experience, and we incorporate these elements into every project we undertake. Let Techugo be your partner in building an investment app that drives growth and success. Get in touch with us today to discuss your vision and explore how we can help you bring it to life.

Post Views: 2,160

SA

SA

KW

KW

IE

IE AU

AU UAE

UAE UK

UK USA

USA

CA

CA DE

DE

QA

QA ZA

ZA

BH

BH NL

NL

MU

MU FR

FR