Imagine a world where everybody would get passive income from their personally owned cryptocurrencies. No middlemen or investment schemes, yet safe and transparent ways to increase your digital assets. Continuing further, DeFi staking is becoming the future of the financial sector, reshaped and revolutionised at every tick of the moment.

Also Read – FinTech in Investment Banking: How It Can Help the Unbanked Population?

Let’s get things on point! Are you an innovative entrepreneur ready to ride this revolutionary wave? If you answered yes, then creating your DeFi staking platform will be the key to entering a splendid world of opportunity. This is because the decentralised finance world has grown exponentially and redesigned the financial landscape. Right at the core of this revolution lies staking. It is a mechanism centralising users earning passive incomes through locking in their crypto assets into a smart contract. DeFi staking platforms have emerged as the cornerstone of attracting both seasoned investors and newcomers seeking high-yield opportunities.

This blog serves as a guide on the DeFi staking revolution assisting businesses in creating their own, meaningful platform. We will cover the gist of staking, the benefits, considerations for businesses and a step-by-step roadmap to development. Maintaining this focus on business value proposition, we aim to arm you with knowledge and techniques on how best to lead to a successful launch and sustaining of a DeFi staking platform.

Understanding the DeFi Staking Landscape

What exactly is DeFi, you might ask. It is a system of financial apps built on blockchain technology. You might as well know that blockchain is leading businesses to a progressive change. Unlike traditional finance, DeFi functions on the principles of decentralisation, transparency, and openness. No middlemen are involved in its midst, like banks; hence, users can have more control over their assets and join financial activities without intermediaries. This translates to advantages like faster transactions, lower fees, and potentially higher returns.

Now, let’s unlock the potential of DeFi through staking. DeFi staking is essentially founded on proof-of-stake blockchains. Contrary to Proof-of-Work blockchains, Bitcoin relies on miners securing the network with computational power, whereas PoS blockchains rely on validators. Users “stake” their crypto holdings to participate as a validator meaning their holdings are effectively locked in a smart contract. These validators then verify transactions and secure the network. As a reward for their contribution, they earn interest on their staked assets.

Developing a DeFi staking platform offers a multitude of advantages for businesses, extending beyond the initial points mentioned. Here’s a closer look at how DeFi staking platforms can benefit your business:

1. Increased User Engagement and Retention

DeFi staking creates this symbiotic relationship between users and the platform boosting the engagement rate. It incentivizes users to hold on to tokens to participate in staking, resulting in increased trading volume and network effects. This encouragement of holding will motivate users to trade frequently on the platform and thus reap further revenue from trading fees. More users attract new users seeking a liquid, active platform, unleashing a self-reinforcing cycle.

2. Enhanced Network Security and Stability

A larger pool of staked tokens strengthens the underlying PoS blockchain network in several ways. Staking requires the locking up of a large amount of tokens by the user. In this way, it makes the cost of implementing a Sybil attack so high that nobody would even try it for anyone’s sake. Besides, higher staking participation puts the responsibility for verifying transactions in the hands of a larger network, which itself makes the chances of one party being able to ‘brandish’ the network even more improbable.

Also Read – Tips for Picking the Most Appropriate Blockchain Development Company for Your Upcoming Project!

3. Diversification of Revenue Streams

DeFi staking platforms offer several ways to generate revenue:

- Transaction Fees: A small fee can be incurred on every transaction that is processed through the staking pool onto platforms.

- Platform Fees: Additional functionality, such as lending or borrowing, may be available on some platforms for which they charge.

- Profit Sharing: Take a small percentage out of the staking rewards generated by users as an added source of revenue by the platforms. This incentivizes the platform to maintain a healthy and attractive staking environment.

4. Building a Strong Brand

A user-centric, secure DeFi staking platform will make a business stand out as a thought leader in the rapidly growing DeFi ecosystem. Consecutively, such strong brand recognition can attract new users, partnerships, and investments.

5. Data Analytics and Insights

User activity offers businesses a rich set of data regarding user behaviour and preferences that may be used for enhancing platform functionality and developing new products and services. Understanding the needs and preferences of users for any feature or offering that constitutes a part of the platform, could be fine-tuned accordingly to ensure a better user experience. Such user data can turn out to be useful for developing new DeFi products and services that answer certain demands.

The beauty of DeFi staking lies in its diverse models. Below is a view of some of the popular choices:

- Fixed Staking: In this model, a lock-in period is predefined for your crypto. You get better interest rates in return for effectively tying up your funds for a predetermined period, usually measured in weeks or months. Your funds are, however, not available to you during this time.

- Flexible Staking: You can stake your crypto and start earning rewards immediately. You will have the freedom to pull out your assets at any time; it might have lower interest rates compared with fixed staking.

- Liquidity Staking: This is an innovative model catering to users who do not want to give up control over their assets. You essentially deposit your crypto into a liquidity pool which DeFi protocols utilise to facilitate trading. In return for the liquidity provided, you earn rewards. However, this liquidity staking introduces what is called the risk of impermanent loss. It means the value of your staked assets may fluctuate because prices have changed.

These are just some examples, and the DeFi staking landscape is changing fast. Armed with an understanding of these core concepts and the different staking models, you can navigate this exciting frontier and earn attractive returns on your crypto holdings. Always remember to do your own research and understand the risks involved before engaging in any DeFi staking platform.

Planning Your DeFi Staking Platform

1. Defining Your Target Audience

Critically understanding who you are building for is your first step. Knowing your target audience spells your vision of a marketplace and strategy from its marketing down to the user experience. Defining your ideal user is crucial because it lets you confirm:

- Tailoring features and functionality based on user needs and technical expertise.

- Craft messages that target your target audience’s pain points and their most critical investment goals.

- Catering to any particular user group and creating that sense of belonging is halfway to building a loyal user base.

Who are you targeting?

- Seasoned Crypto Enthusiasts: Advanced staking options, like liquid staking, yield aggregation, and governance staking, would be of much interest to knowledgeable users of DeFi so that with staking, higher levels of risk can be sustained for features that give users more flexibility and therefore higher possible returns. They will also appreciate detailed visualisations for staking rewards, network health, and token performance to satisfy their analytical minds.

- Crypto-Curious Newcomers: Users well-versed in DeFi concepts like staking and with a high-risk tolerance may find appeal in advanced staking options such as liquid staking, yield aggregation, and governance staking, as these offer flexibility and potentially higher returns. In addition, they might appreciate detailed visualisations of staking rewards, network health, and token performance to cater to their analytical mindsets.

2. Features and Functionality

Having defined your target audience, it’s time to translate user needs into concrete features and functionalities for your DeFi staking platform. Here are some essential elements to consider:

- Integrate Secure and User-friendly Wallet Integration: At the heart of the platform, this is where users will store crypto assets and interact with staking features. Keep in mind the integration of wallets that are popular among your target audience.

- Diverse Staking Options for Different APYs: Offer different risk-appetite types of staking options. This could include fixed-term staking with returns guaranteed, flexible staking with variable APYs, and probably advanced options such as liquid staking and yield aggregation for specific audiences.

- Real-Time Data Visualization and Performance Tracking: An easy and informative dashboard must be provided to users with real-time data regarding their staking performance. This helps users track their staked assets, accrued rewards, and estimated returns in real time. This may include visualisations of network activity, transaction volume, and validator distribution to instil confidence in the security of the platform among users. It should further provide charts and data feeds for the price performance of the staked token and other relevant DeFi tokens, empowering the user to make an informed investment decision.

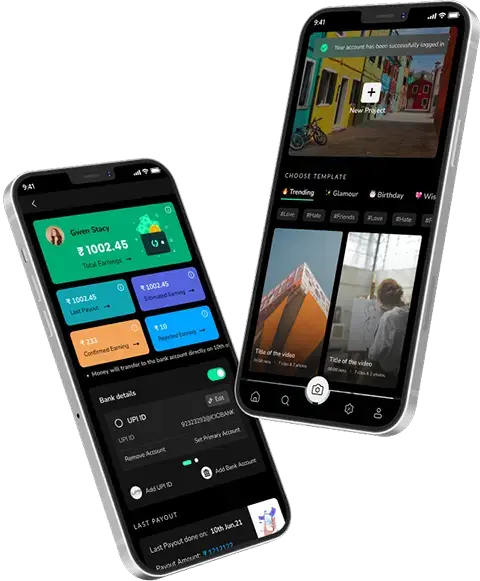

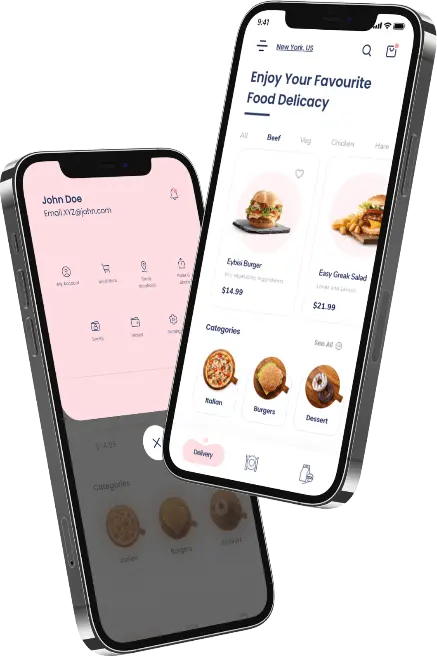

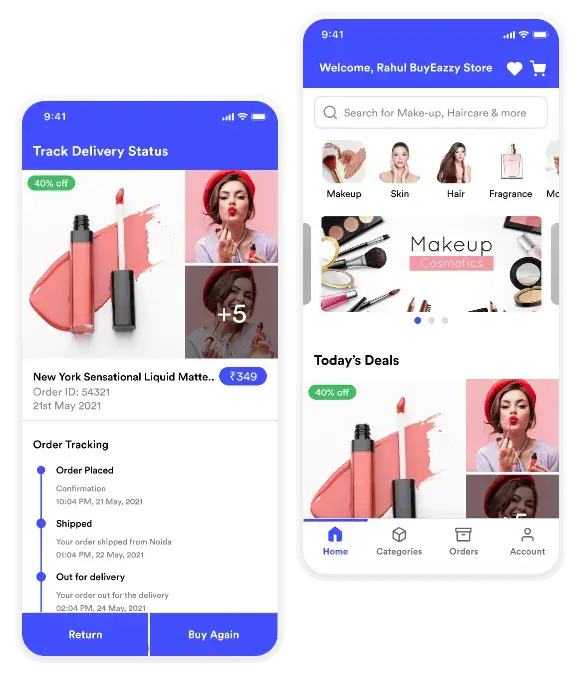

- An Intuitive Desktop and Mobile UI: The UI is key to onboarding and retaining users. For beginners, it should be easy to use and clean, with clear instructions and tooltips. For advanced users, there should be more advanced features and data visualisations available without sacrificing ease of use.

- Mobile App Development: A dedicated mobile app for your DeFi staking platform is non-negotiable for competitive advantage. You should team up with a skilled mobile app development company in USA to deliver an intuitive and secure mobile experience. This caters to users who want to manage their investments on the go.

3. Security Considerations

As you navigate the DeFi landscape, remember that data security is paramount. A single exploit can shatter user trust and cripple your platform. Here are some crucial strategies to mitigate security risks:

- Rigorous Smart Contract Audits: The latter make up the core of your DeFi staking platform. Collaborate with some credible development team that takes care of secure smart contract coding practices. Do not cut corners on cost here rather, invest in detailed audits from independent security firms with experience in DeFi smart contracts. Such audits will pinpoint and rectify any potential vulnerabilities before their being exploited by malicious actors.

- Multi-Factor Authentication (MFA): Provide additional security by requiring that users have MFA while logging into their accounts and making transactions. It may include but should not be limited to a combination of passwords, one-time codes from authenticator apps, or biometric verification such as fingerprint or facial recognition.

- Integrate APIs Securely: Be sure to provide secure API connections to your platform if it is going to be integrated with third-party services or wallets. Conduct independent security testing to ensure the establishment of access controls and mechanisms for the strong encryption of users’ protected data and assets, protecting it against unauthorised access.

- Bug Bounty Program: Run a bug bounty program whereby security researchers are rewarded for reporting any vulnerability they identify within the platform. That way, you are successfully addressing those security weaknesses, beforehand, or at least potentially, by rewarding those “white hat” hackers.

4. Scalability and Performance

The DeFi market is experiencing explosive growth. To ensure your platform thrives in the long run, plan for future scalability:

- Scalable Architecture: Design a scalable architecture that would be able to sustain an increasing volume of users and the volume of transactions without performance degradation. Consider blockchain solutions like sharding or layer-2 protocols for scalability. Partnering with a blockchain app development company can make it easy to design such scalable solutions.

- Load Balancing: This can be realised through load balancing techniques, dispersing the number of user requests across servers to avoid probable bottlenecks and guaranteeing smooth operations during peak usage hours.

- Performance Optimization: Run regular platform performance monitoring and identify areas that can be optimised. This could involve code optimization, database indexing, or caching strategies.

Embarking into the Development Process and Timeline

1. The Development Journey

Building a robust DeFi staking platform requires careful planning and a well-defined app development process. Here’s a breakdown of the key stages involved:

a) Concept Development and Planning

- Define the platform’s core functionalities and value proposition.

- Identify your target audience and their specific needs.

- Outline the features and services you’ll offer.

- Develop a clear roadmap for platform development and launch.

b) Smart Contract Development and Audit

- Partner with a team of experienced DeFi developers to create secure and efficient smart contracts. These contracts will automate staking functionalities, reward distribution, and user interactions.

- Once developed, engage independent security firms to conduct rigorous audits of your smart contracts. This crucial step helps identify and address potential vulnerabilities before they can be exploited.

c) Front-End and Back-End Development

- Design an intuitive user interface targeted at the audience of use: front-end UI. Consider extendibility to both desktop and mobile apps for easier access.

- Work on the back-end systems for data storage, user authentication, and communication with the blockchain network.

- Ensure smooth integration between the front-end UI and back-end systems for a seamless user experience.

d) Rigorous Testing and Deployment

- Conduct thorough testing of your platform across various scenarios. This includes unit testing, integration testing, and security testing. Simulate real-world user interactions and potential stress situations to ensure platform stability.

- Once rigorous testing is complete, deploy your platform in a controlled environment for further user testing and bug identification. This allows for final refinements before a public launch.

e) Ongoing Maintenance and Support

- The development process doesn’t end with the launch. Provide ongoing maintenance and support to ensure platform stability, address user concerns, and implement necessary updates.

- Be prepared to adapt to evolving DeFi and Fintech app trends, regulations, and customer reviews and ratings to maintain a competitive edge.

2. Timeline Estimation

While a precise timeline hinges on several factors, here’s a general timeframe for developing a DeFi staking platform:

- A smaller time frame applies to a relatively basic platform with core staking functionalities and a limited feature set. It assumes a small, experienced development team working with pre-existing, well-audited smart contracts.

- A moderate timeline applies to a more realistic timeframe for most platforms. It allows for incorporating a wider range of features, a user-friendly interface, and mobile app development. Complexity in staking options (like liquid staking or yield aggregation) would also extend this timeframe.

- A brief, time-consuming timeline is considered for highly complex platforms with innovative features. This also includes intricate smart contract designs and robust security measures that could take a year or more to develop and rigorously test.

3. Budget Considerations

Developing a DeFi staking platform requires a significant investment. What might impact your overall budget?

- The complexity and number of features directly affect development costs. Advanced staking options, real-time data visualisations, and a mobile app will require additional resources compared to a basic platform.

- The experience level and location of your development team play a crucial role. Highly skilled developers with DeFi expertise will command a premium compared to less experienced teams.

- Simple staking functionalities require less complex smart contracts, leading to lower development costs. Conversely, intricate smart contract designs with features like liquid staking or governance staking will require more development time and expertise, translating to higher costs.

Monetizing Your DeFi Staking Platform

Having poured resources into developing a secure and feature-rich DeFi staking platform, you now need to consider how to generate revenue and ensure its sustainability.

- Consider different revenue streams for your staking pool, such as transaction fees and additional feature charges

- Strike a balance with transaction fees to avoid discouraging users or generating insufficient revenue

- Implement a profit-sharing model to take a small cut of staking rewards as an incentive to maintain an attractive platform

- The platform’s native token could potentially appreciate if your platform gains traction, benefiting you if you hold a significant amount

- Analyse user behaviour to gather valuable data on DeFi trends and user preferences, which can be anonymized and sold or used to develop new DeFi products and services

- A successful DeFi staking platform can establish you as a thought leader and attract lucrative partnerships, grants, and investment opportunities

The ideal monetization technique will vary with your platform’s features, target audience, and general business goals. Think of a hybrid approach to help set up continual revenue without the input of any particular factor, which risks the user experience or cybersecurity of the platform. Remember, building trust and earning a loyal group of users within the competitive DeFi landscape shall come first. By delivering value-added services and making the concerns of users a priority, a DeFi staking platform shall realise long-lasting success.

Embracing the Future of Finance with DeFi Staking

There are compelling advantages for businesses and users who build a staking DeFi platform. Users could get more value from their assets in staked projects to spend on other DeFi services in many ways. It provides a secure and approachable way to earn passive income using staking. Keeping holders incentivized to hold tokens in the first place, further uplifts brand equity through a loyal user base. This platform provides businesses with different streams of revenue, abstracting transaction fees, premium features for subscription fees, and a profit-sharing model for altogether maximum adoption. The strategic advantages that come along, increase the value of its native token, increased reputation, and valuable information on user behaviour to drive product development. A good user experience, high-end security, and comprehensive feature set are all to be regarded if a business model is to be set up that will last long.

Techugo, a leading mobile app development company with extensive expertise in DeFi solutions, is here to guide you on your journey. Our team of seasoned developers can translate your vision for a groundbreaking DeFi staking platform into reality. We’ll navigate the development process, ensuring a secure, user-friendly platform that capitalises on the immense potential of DeFi staking. Get in touch with Techugo and embrace the future of finance together. Let’s turn your DeFi vision into a reality that revolutionises the way users interact with their cryptocurrency holdings.

Post Views: 1,546

SA

SA

KW

KW

IE

IE AU

AU UAE

UAE UK

UK USA

USA

CA

CA DE

DE

QA

QA ZA

ZA

BH

BH NL

NL

MU

MU FR

FR